Trading Systems

Built for MetaTrader 4 & 5

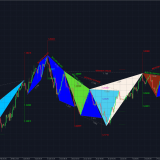

Harmonic Patterns Trading System

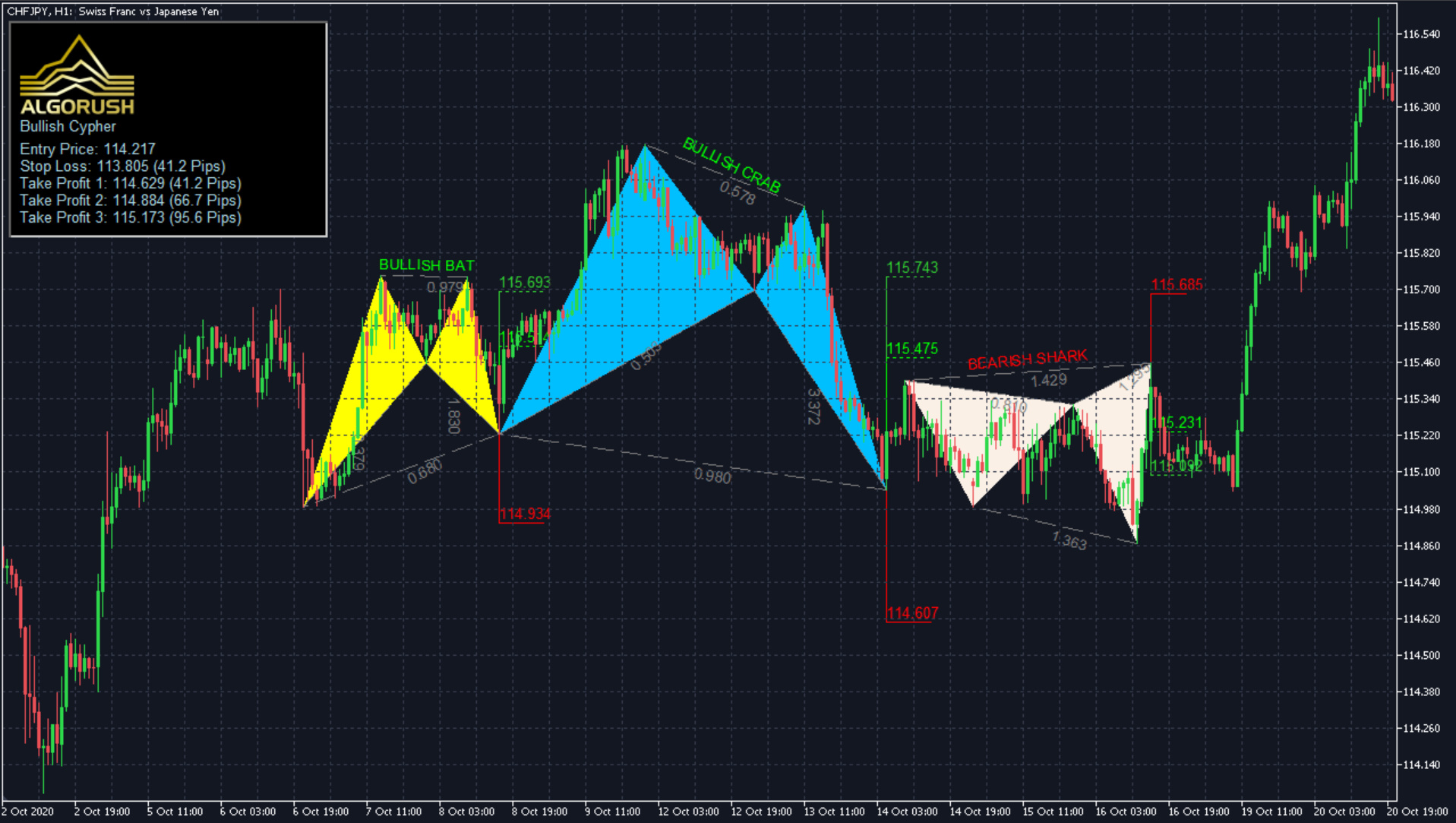

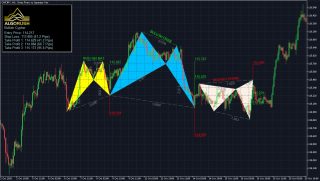

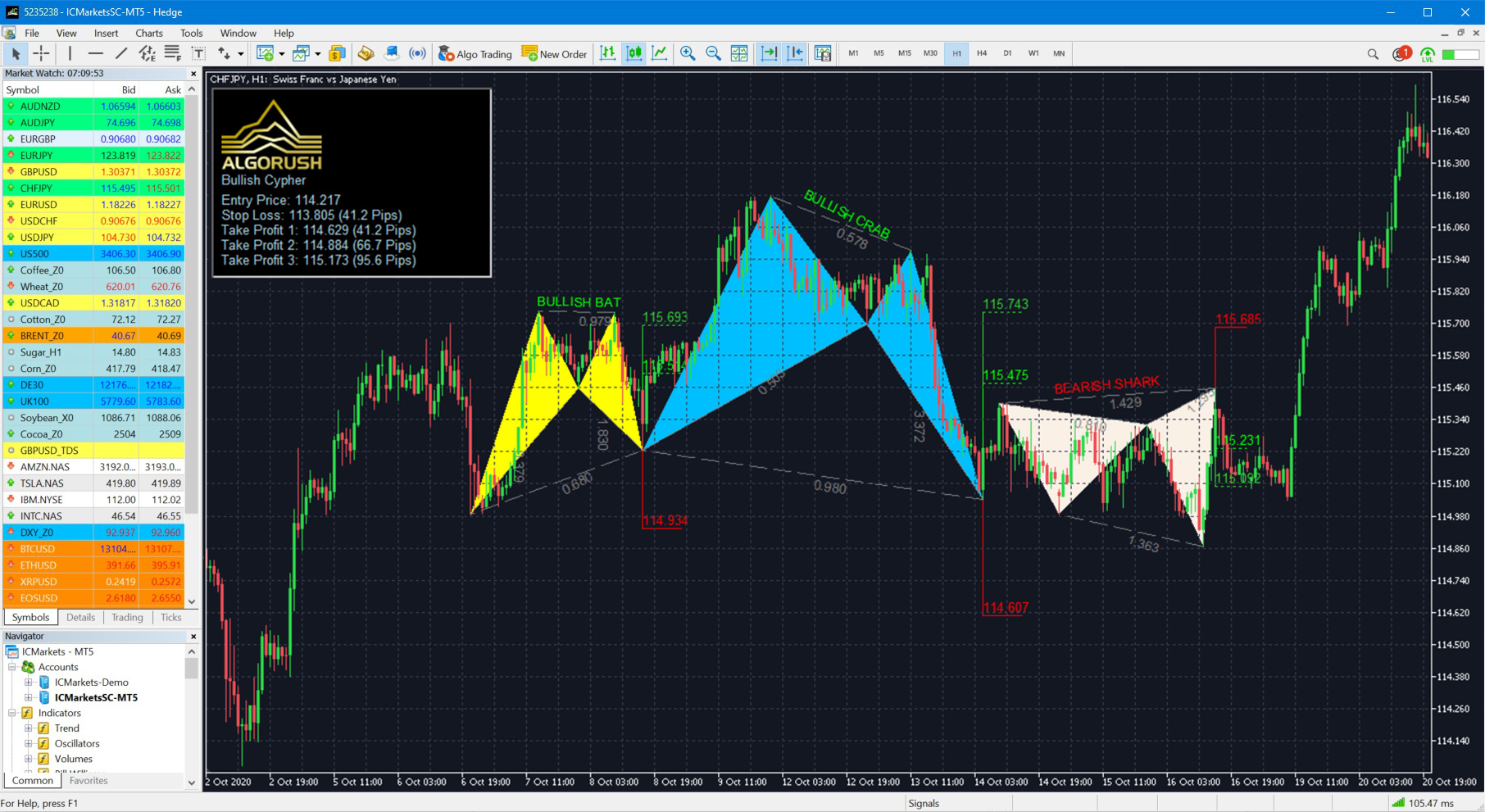

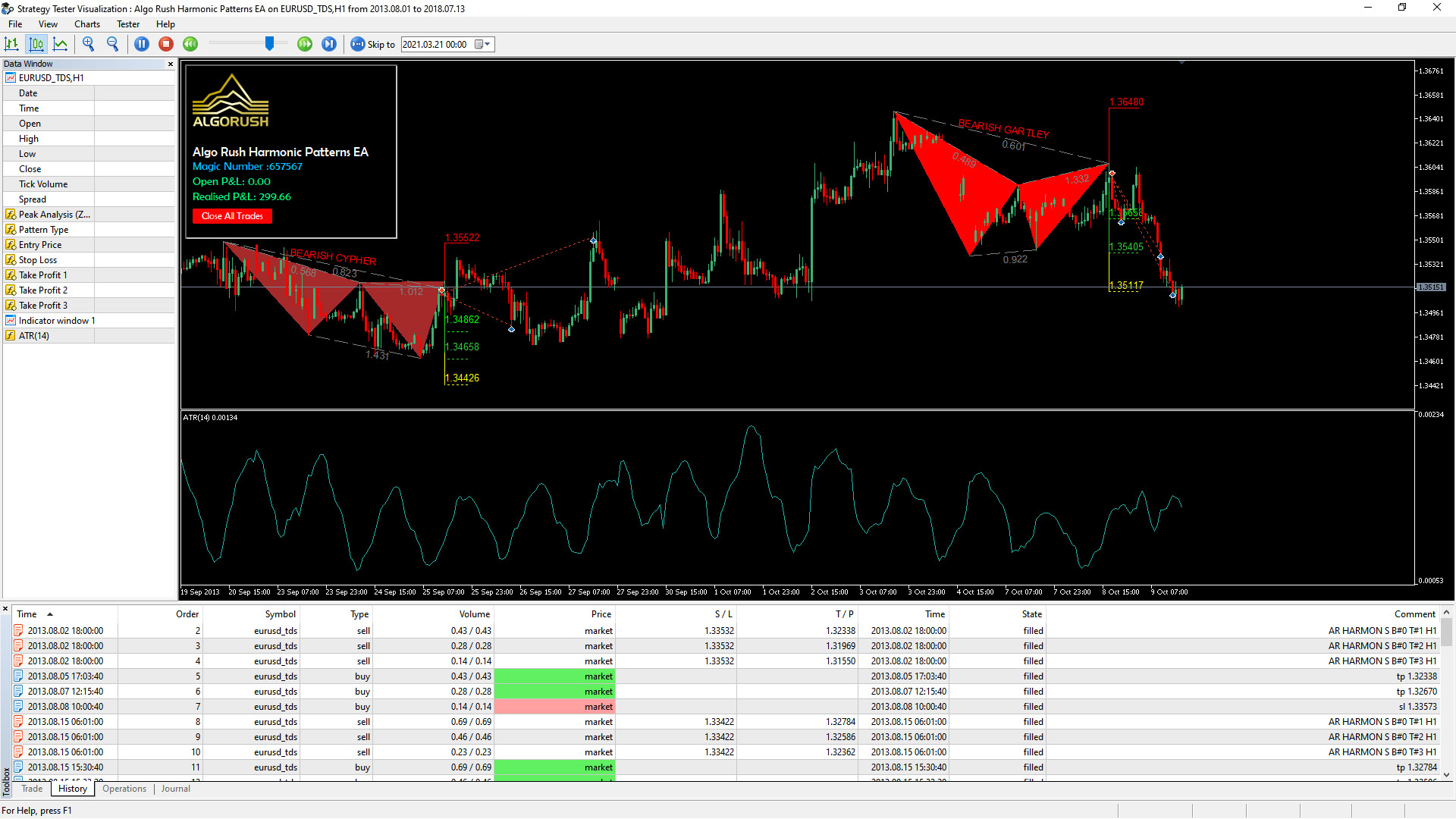

The Harmonic Patterns Trading System scans for thirteen types of harmonic patterns with a optimizable parameters for calculating turning points, take-profits, stoplosses and trailing values. The system uses price data to confirm turning points for Fibonacci extensions and retracements.

Unlike other common price trading methods, the system attempts to predict future movements by incorporating either the Potential Reversal Zone (PRZ) or the Price Continuation Zone (PCZ) methodology which are customizable with user-defined inputs.

Works seamlessly on any asset class including Forex, stocks, commodities, futures and crypto. Trading setups which use harmonic patterns on top of existing strategies help providers traders with additional support for locating entries and target levels.

What’s included in The Harmonic Patterns Trading System:

- Harmonic Patterns Indicator for MetaTrader 4 & 5

- Harmonic Patterns Expert Advisor (EA) for MetaTrader 4 & 5

- Harmonic Patterns Multi-Pair/Timeframe Dashboard for MetaTrader 5

- Indicator, EA and dashboard user guides/documentation on our wiki

- Order Snipe MT5 Bridge Addon: Interactive Brokers & Crypto Exchanges

Indicator Dashboard Expert Advisor (EA)

Tradingview, NinjaTrader, eSignal & MultiCharts versions coming soon.

The Harmonic Patterns System is included in our subscription package which comes equipped with all trading systems and billed either monthly, quarterly or annually.

SubscribeProduct Description

Harmonic Patterns System Overview

Harmonic Patterns System Overview

Harmonic patterns primarily consist of geometric pattern structures using Fibonacci sequences. The geometric price pattern structures are defined by both retracement and projection Fibonacci levels that are plotted from reversal swings and legs. Harmonic pattern structures provide unique opportunities for traders, such as potential price movements and key turning or trend reversal points. This factor adds an edge for traders as harmonic patterns attempt to provide highly trustworthy information on price entries, stops and targets information.

Built specifically for harmonic traders and harmonic pattern enthusiasts who are familiar with both Pattern Completion Zone (PCZ) and Potential Reversal Zone (PRZ) reversal methodologies. The system is currently available for both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The harmonic pattern indicator, dashboard and Expert Advisor (EA) are non-lagging and non-repainting with options to optimize projected harmonic trading setups thus enabling users to receive the same results for the same parameters used on different system components.

Reversal methodologies used in the system:

-

-

- Potential Reversal Zone (PRZ)

- Pattern Completion Zone (PCZ)

- also known as the Potential Completion Zone (PCZ)

-

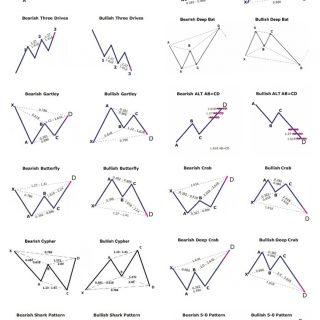

Harmonic patterns included in the system:

-

-

- 5-0 Pattern

- AB=CD Pattern

- Alternate AB=CD Pattern

- Gartley Pattern

- Bat Pattern

- Alternate Bat Pattern

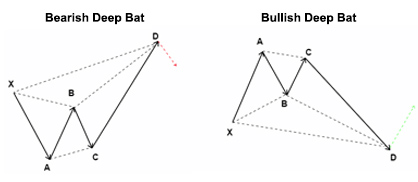

- Deep Bat Pattern

- Crab Pattern

- Deep Crab Pattern

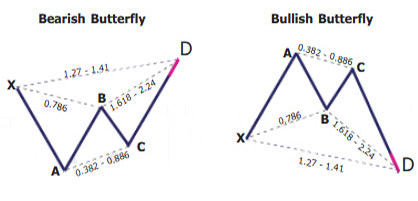

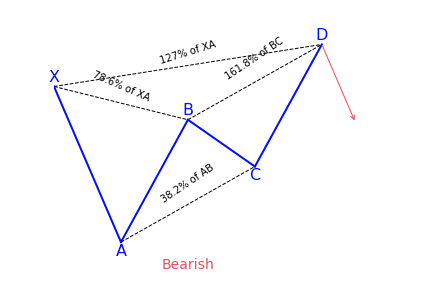

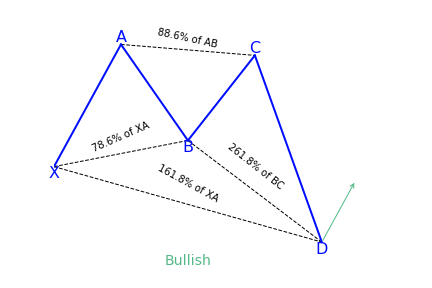

- Butterfly Pattern

- Shark Pattern

- Cypher Pattern

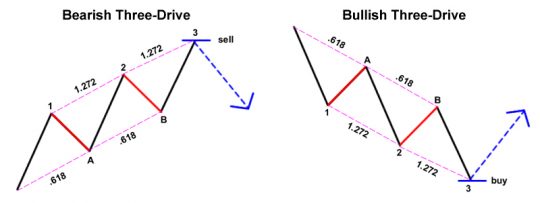

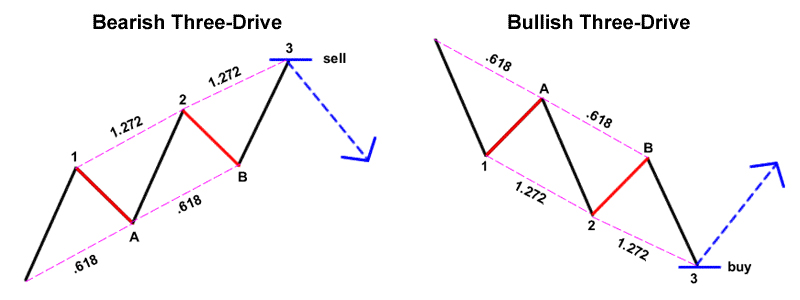

- Three Drive Pattern

-

Supported platforms for each system component:

–

Harmonic Pattern Indicator

-

-

- Harmonic Pattern Indicator for MetaTrader 4 (MT4)

- Harmonic Pattern Indicator for MetaTrader 5 (MT5)

-

Harmonic Pattern Expert Advisor (EA)

-

-

- Harmonic Pattern Expert Advisor (EA) for MetaTrader 4 (MT4)

- Harmonic Pattern Expert Advisor (EA) for MetaTrader 5 (MT5)

- Recommended for machine learning when performing fast and slow genetic optimizations

-

Harmonic Pattern Dashboard

-

-

- Harmonic Pattern Dashboard for MetaTrader 5 (MT5)

-

Coming soon to the following charting & trading platforms:

-

-

- Tradingview

- NinjaTrader

- eSignal

- MultiCharts

-

Harmonic pattern lessons are also available:

-

-

- Harmonic Trading 101

- What are Harmonic Patterns?

- How to Trade Harmonic Patterns

- XABCD & Other Harmonic Variations

- Harmonic vs. Geometric Patterns

- Reversal & Turning Point Methods

- Potential Reversal Zone (PRZ)

- Pattern Completion Zone (PCZ)

- Harmonic Trading Patterns

- All 13 harmonic patterns from the Harmonic Pattern System

- Harmonic Trading 101

-

References

https://algorush.com/wiki/harmonic-patterns-system-overview

https://algorush.com/trading-systems-for-metatrader/harmonic-patterns-overview/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Trading Systems

-

From: $19.99 / month with 1 week free trial

Harmonic Pattern Indicator

Harmonic Patterns Indicator

The Harmonic Patterns Indicator is available on MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Trader can view over twelve harmonic patterns while using either the Potential Reversal Zone (PRZ) or the Pattern Completion Zone (PCZ) to determine key reversal points along with their targets within past and upcoming projections. The harmonic pattern indicator can also be loaded on Order Snipe which allows users to have access to stocks and futures charts on Interactive Brokers (IB) and several crypto exchanges including Binance, BitMEX, FTX, KuCoin and more.

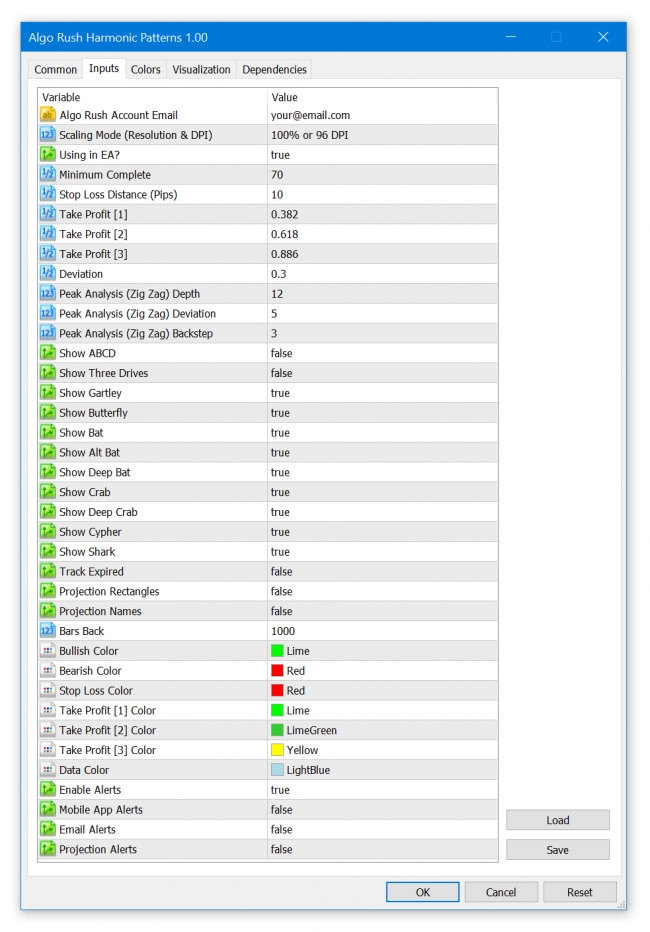

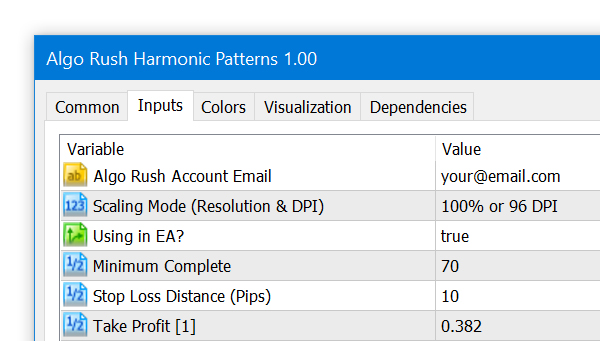

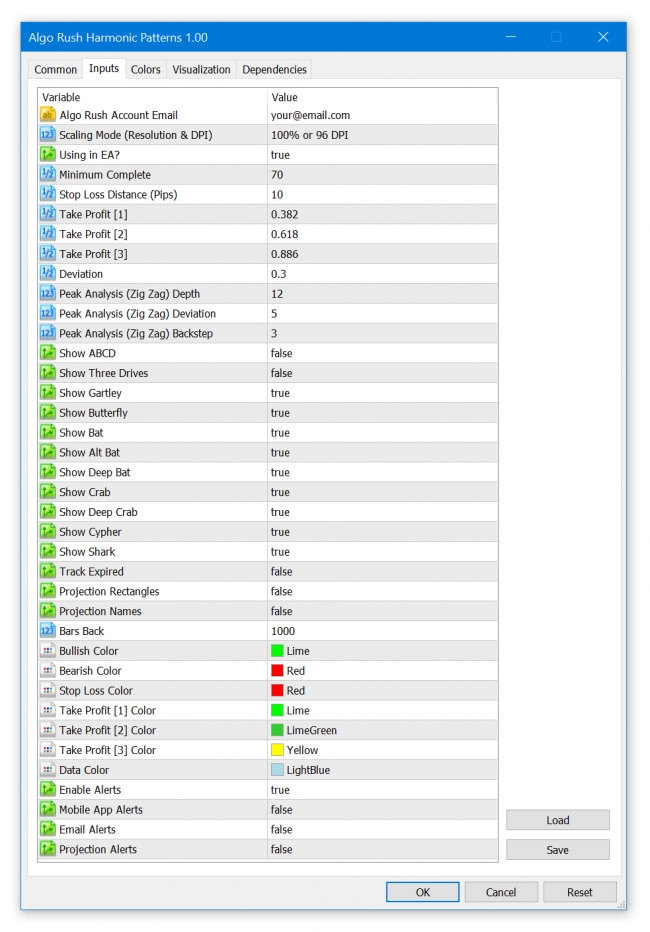

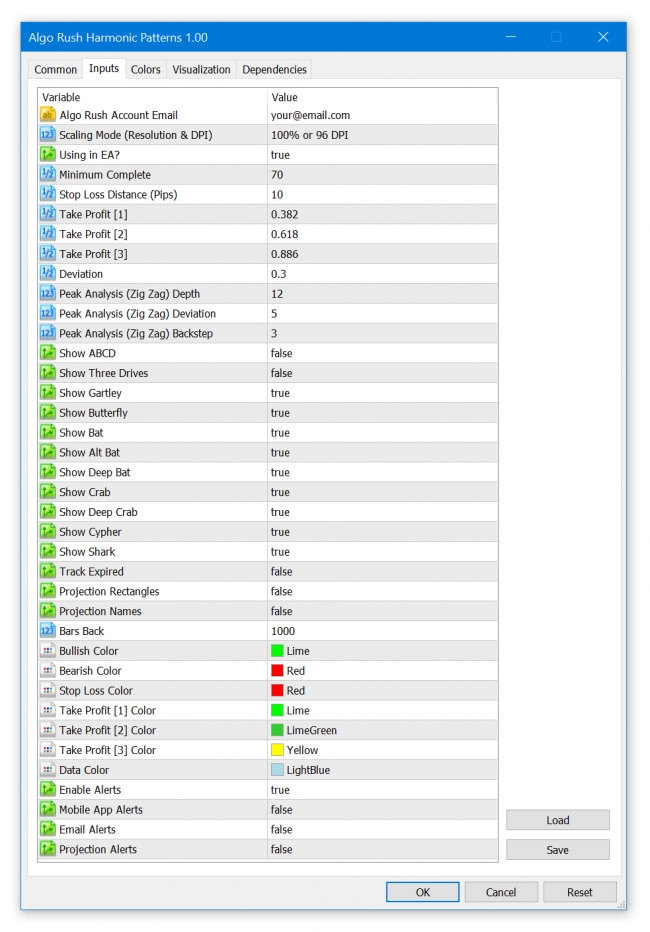

Harmonic Patterns Indicator Settings on MetaTrader 4 & 5

Algo Rush Account Email

The email address that the active Algo Rush subscription is under.

- Note: The indicators and Expert Advisors will not initiate without an email address linked to an active subscription.

Scaling Mode (Resolution & DPI)

Users with either resolutions above 1080p (1920×1080) or DPIs above 96 will need to adjust the scaling mode settings to an option above the default 100% value. Adjusting this will resolve any issues with displaying objects such as text, buttons and windows within active charts.

- 100% or 96 DPI (default)

- 125% or 120 DPI

- 150% or 144 DPI

- 175% or 168 DPI

- 200% or 192 DPI

- 225% or 216 DPI

- 250% or 240 DPI

Using in EA?

When you are using the indicator inside an EA you should set it true to prevent drawing visual objects so the EA will save data of detected harmonic pattern in a separate text file for further use.

- Default: false

Min. Complete

A form of deviation but only for projection patterns. When you set ‘Deviation’ paramater too strict the scanner will check the MinComplete parameter. How much you decrease will form more projections as a result.

- Default: 70

SL Distance (Pips)

You can increase SL level by increasing this value, it’s simply just additional pips to stop loss fib level.

- Default: 10

TP [1]

The first multiplier within the fib range for determining second take profit level.

- Default: 0.382

TP [2]

The second multiplier within the fib range for determining second take profit level.

- Default: 0.618

TP [3]

The third multiplier within the fib range for determining second take profit level.

- Default: 0.886

Deviation

A number to determine the percentage of how much away a pattern can deviate from its original harmonic pattern structure. How much you increase it will increase the number of detected patterns that have a higher deviation from the original patterns’ ratio. Keeping it low will give you less patterns with the trade-off for getting cleaner and more appropriate pattern matches.

- Default: 0.3

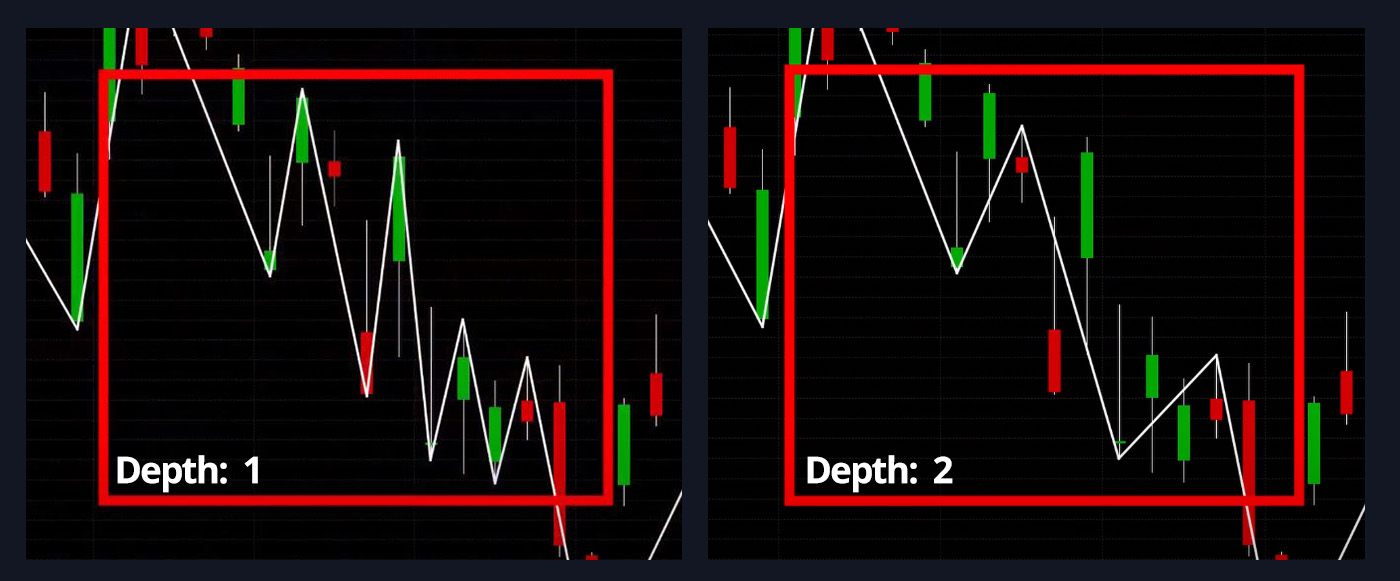

Peak Analysis Depth

- Default: 12

A minimum amount of periods needed for the trend to be able to change/switch. With a depth of 1, the trend can change every period (bar) however with a depth of 2 the trend can change only starting from 2 periods (bars). The value you use ultimately depends on what the length of your chosen period is. Below is an example:

Depth – the parameter allows to specify the minimum number of periods, needed to draw one segment of the indicator’s line. The possible values are from 1 through 10,000. The default value is 12. The smaller the number is, the shorter the segments are and the line changes its direction more often. The greater the number is, the longer the segments are, and the line changes its direction less frequently. A trader chooses the Depth parameter’s value in accordance with what chart figures need to be identified. For identifying Harmonic Patterns and Elliott Waves, for example, the commonly used value is 12 (default).

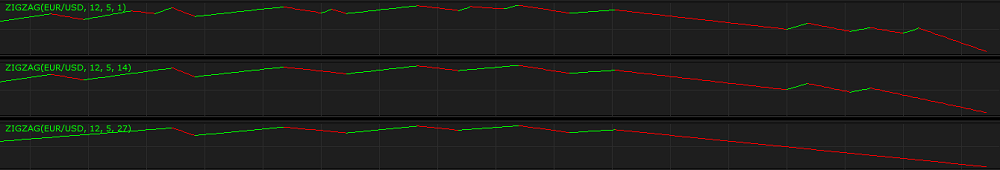

Above you can see examples of ZIGZAG indicators with different Depth parameter’s values (2, 12, 100) drawn in additional areas.

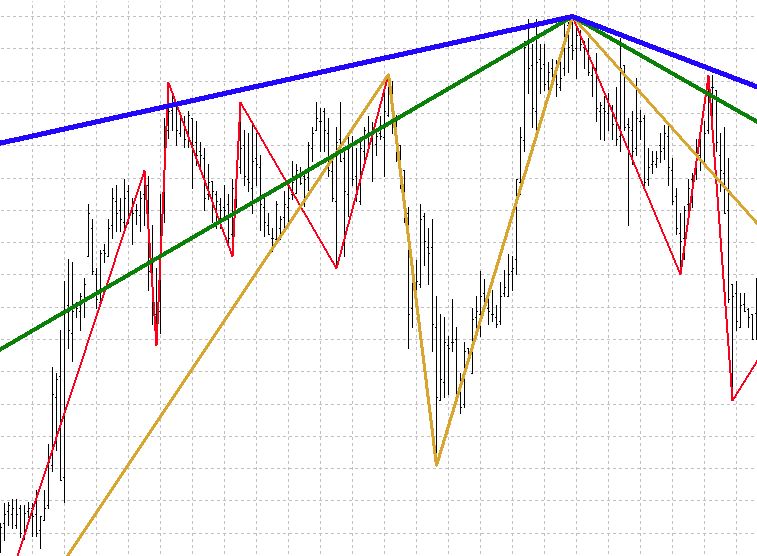

Peak Analysis Deviation

- Default: 5

The minimum percentage that price has to change in order for the trend to change directions. The default value is 5. A trader chooses the Backstep parameter’s value in accordance with what chart figures need to be identified.

- Will look for the previous low, then look for the uptrend.

- For shorts it will look for the previous high, then look for the downtrend.

In the example below, we included a variety of different zigzag lines with different deviation values. These differences in deviation values determine how strong a rebound has to be (in terms of % change) for a pivot to be considered. This works in conjunction with the “Depth” option since that option defines the minimum amount of periods (bars) required since the last rebound if the deviation rule becomes valid at any time.

- Blue line: 5% deviation (highest deviation value, least elastic to changes)

- Green line: 3% deviation

- Yellow line: 1.5% deviation

- Red line: 1% deviation (lowest deviation value, most elastic to changes)

Peak Analysis Backstep

- Default: 3

Backstep reflects the minimum amount of bars between which the high and low can be plotted, you can think of this of the total width of the potential fib retracement/extension based off candlestick width periods. These settings should be adapted to various financial markets and you will probably end up using different settings for one market, instrument, price/harmonic pattern, and so fourth. Additionally, you could also end up changing the settings for the same market or indicator when the market conditions change along with its volatility.

Backstep – the parameter allows to specify the number of bars backwards from the current bar to be used for an assessment triggered by reaching or surpassing the Deviation parameter’s value. The possible values are from 1 through 10,000. The default value is 3. The smaller the number is, the shorter the segments are and the line changes its direction more often. The greater the number is, the longer the segments are, and the line changes its direction less frequently. A trader chooses the Backstep parameter’s value in accordance with what chart figures need to be identified. For identifying Elliott Waves, for example, the commonly used value is the default one – 3.

Above you can see examples of ZIGZAG indicators with different Backstep parameter’s values (1, 14, 27) drawn in additional areas.

Show ABCD

- Default: false

Show 3 Drives

- Default: false

Show Gartley

- Default: true

Show Butterfly

- Default: true

Show Bat

- Default: true

Show Alternate Bat

- Default: false

Show Deep Bat

- Default: false

Show Crab

- Default: true

Show Deep Crab

- Default: true

Show Cypher

- Default: true

Show Shark

- Default: true

Bars Back

The amount of bars to scan back from the current bar, try to keep this to a minimum to avoid over consumption of client resources.

- Default: 5000

Bullish Colour

- Default color: Lime

Bearish Colour

- Default color: Red

SL Color

- Default color: Red

TP[1] Color

- Default color: DarkGreen

TP[2] Color

- Default color: Green

TP[3] Color

- Default color: Lime

Data Color

- Default color: Light Blue

Info Panel Pixel Shift

- Default: 0

- For resolutions higher than 1080p such as 2k, 4k, etc: 5-20.

Enable Alerts

- Default: true

Mobile Alerts

- Default: false

Mail Alerts

- Default: false

Projection Alerts

- Default: false

References

https://algorush.com/wiki/harmonic-patterns-indicator

https://algorush.com/trading-systems-for-metatrader/harmonic-patterns-indicator/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Trading Systems

-

From: $19.99 / month with 1 week free trial

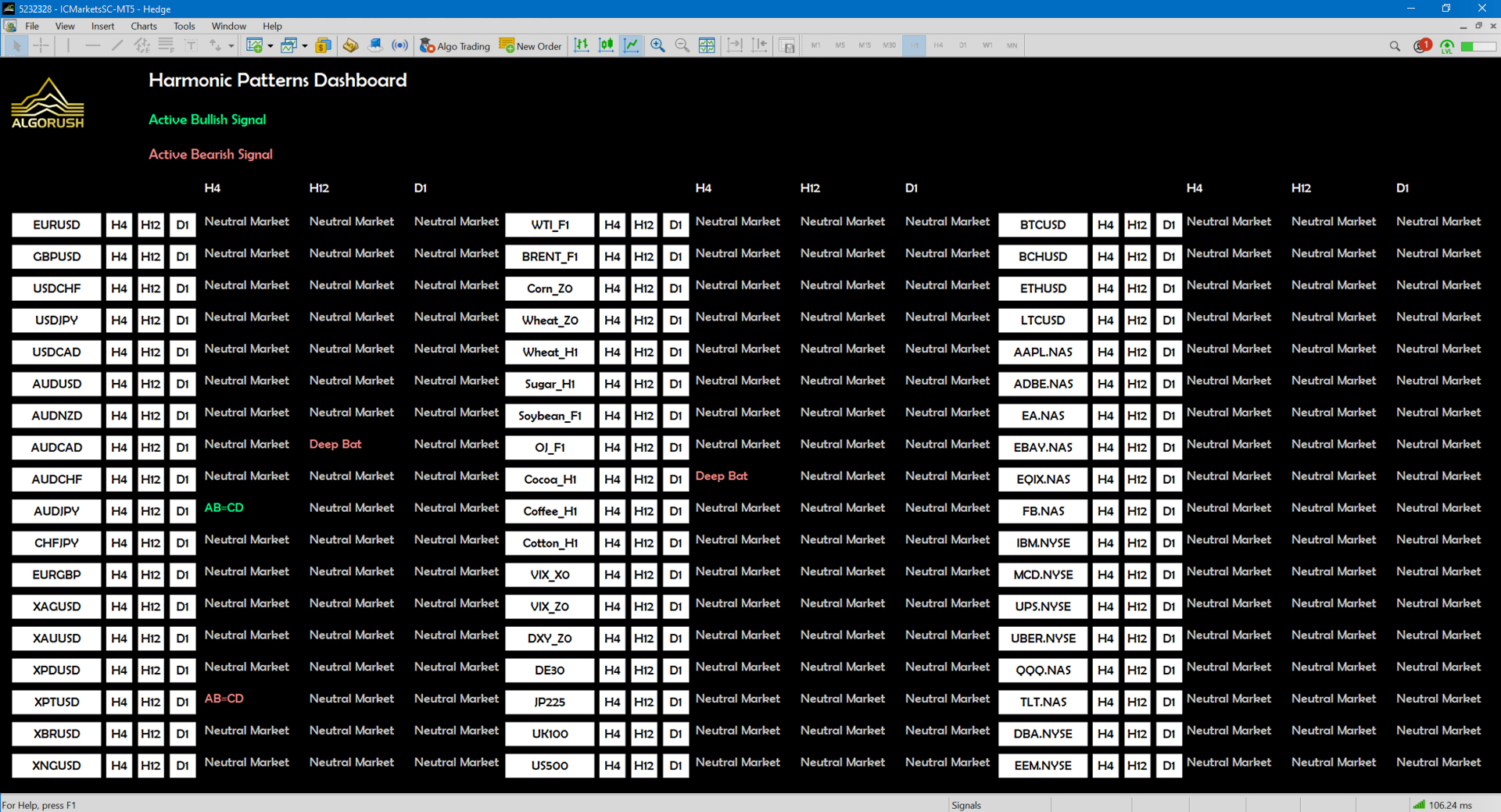

Harmonic Pattern Dashboard

Harmonic Patterns Dashboard

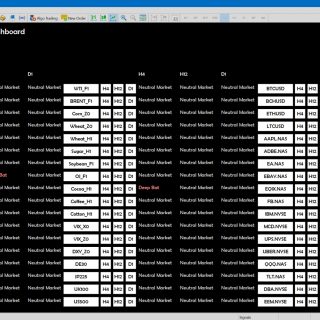

The harmonic patterns dashboard is exclusively available on MetaTrader 5 only. The harmonic pattern dashboard is capable of monitoring dozens of pairs while offering up to 21 different timeframes for each pair. When loading many pairs with all patterns enabled, please note that a PC or VPS with sufficient amounts of RAM and CPU cores will be required since this trading system is heavily math based.

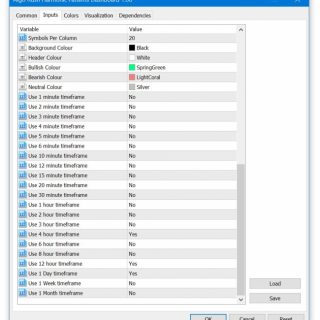

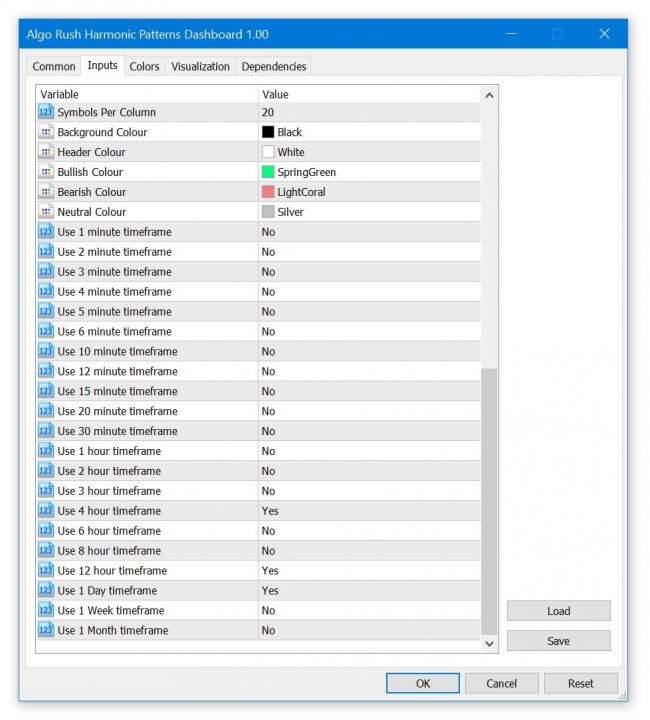

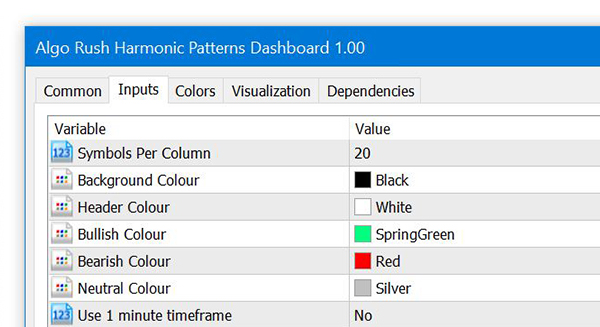

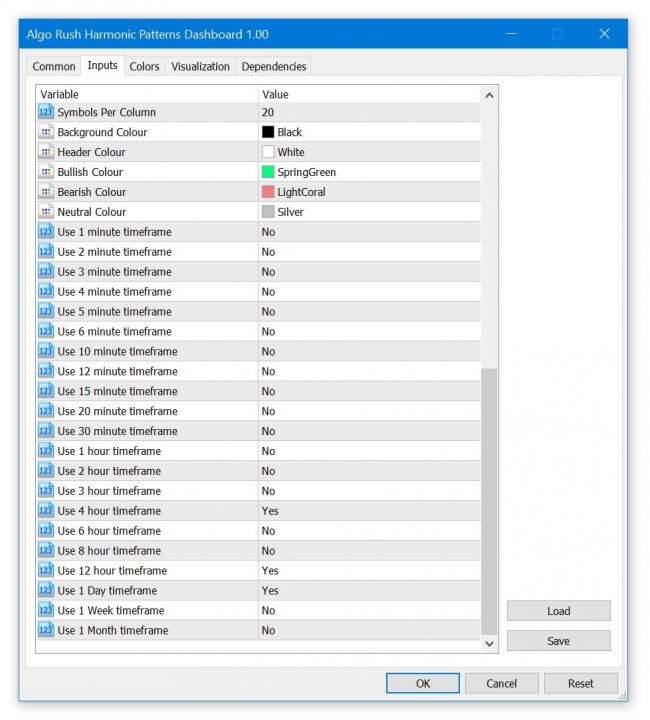

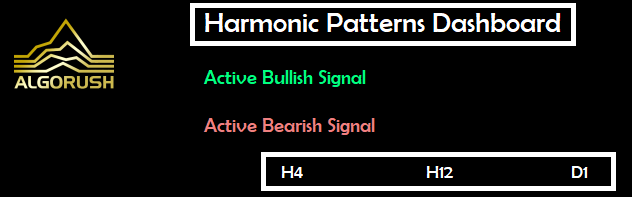

Harmonic Patterns Dashboard Settings on MetaTrader 5

Symbols (Format=”GBPUSD,EURUSD”)

Leave this blank to have the symbols in the Market Watch window used. See image below:

- Default: (blank – uses the symbols in Market Watch instead)

- Type a pair such as GBPUSD to override fetching from the Market Watch.

- Seperate each pair with a comma only and no space.

- Example: GBPUSD,EURUSD,XAUUSD,USDCAD,BTCUSD

Symbols Per Column

This will define how many symbols/rows each column contains within the dashboard. Adjusting this is helpful if users either have ultra-wide or portrait orientation displays.

- Default: 20

In this example, we used 18 as the value for the symbols per column since we loaded 52 pairs on 3 rows.

Background Colour

- Default: Black

Header Colour

Change only when the default background colour is changed from black to a lighter colour.

- Default: White

Bullish Colour

- Default: SpringGreen

Bearish Colour

- Default: LightCoral

Neutral Colour

- Default: Silver

Use 1 minute timeframe

- Default: No

Use 2 minute timeframe

- Default: No

Use 3 minute timeframe

- Default: No

Use 4 minute timeframe

- Default: No

Use 5 minute timeframe

- Default: No

Use 6 minute timeframe

- Default: No

Use 10 minute timeframe

- Default: No

Use 12 minute timeframe

- Default: No

Use 15 minute timeframe

- Default: No

Use 20 minute timeframe

- Default: No

Use 30 minute timeframe

- Default: No

Use 1 hour timeframe

- Default: No

Use 2 hour timeframe

- Default: No

Use 3 hour timeframe

- Default: No

Use 4 hour timeframe

- Default: Yes

Use 6 hour timeframe

- Default: No

Use 8 hour timeframe

- Default: No

Use 12 hour timeframe

- Default: Yes

Use 1 Day timeframe

- Default: Yes

Use 1 Week timeframe

- Default: No

Use 1 Month timeframe

- Default: No

References

https://algorush.com/wiki/harmonic-patterns-dashboard

https://algorush.com/trading-systems-for-metatrader/harmonic-patterns-dashboard/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Trading Systems

-

From: $19.99 / month with 1 week free trial

Harmonic Pattern Expert Advisor

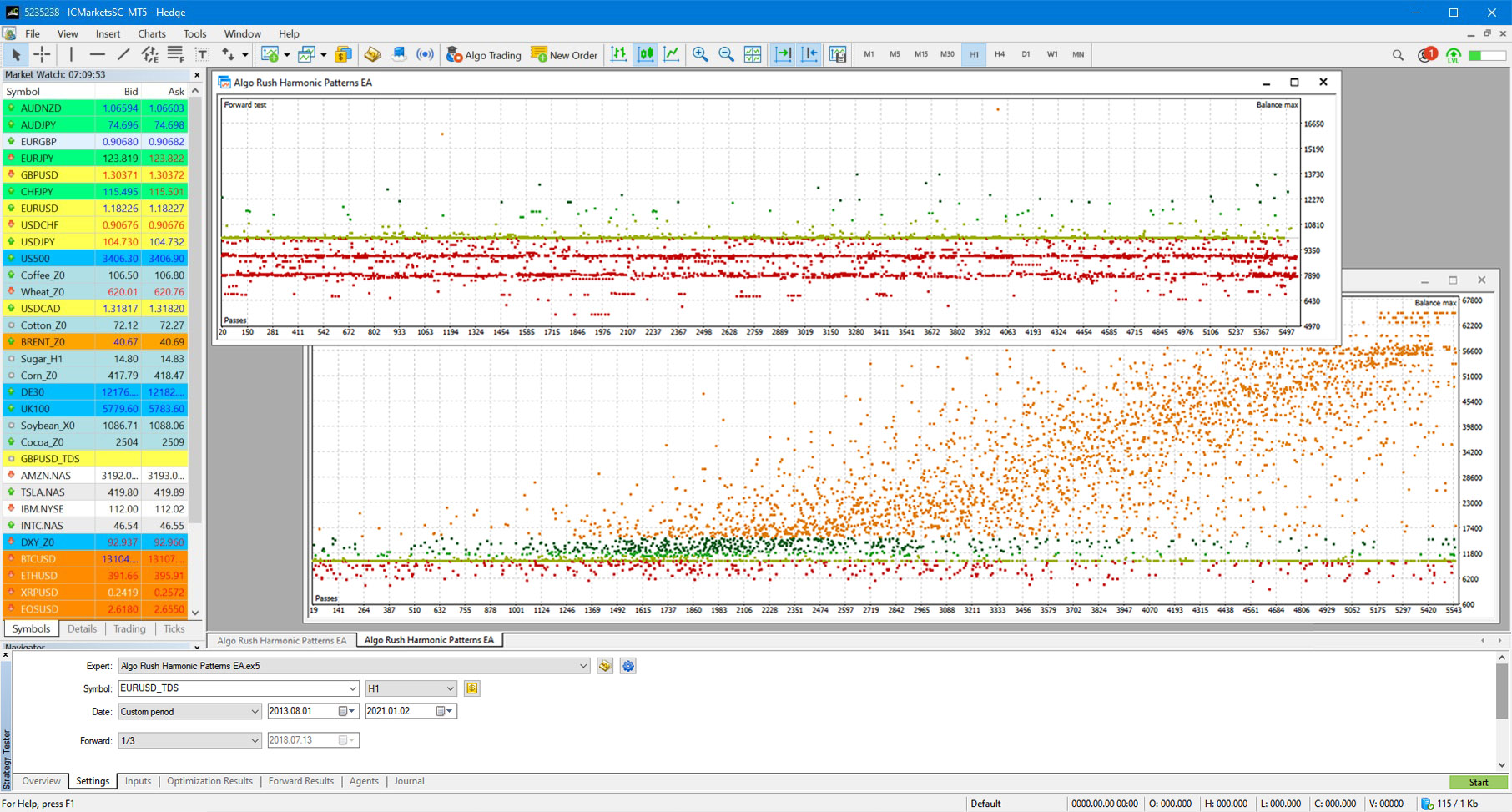

Harmonic Patterns Expert Advisor (EA)

The Harmonic Patterns EA is available on MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Trade over twelve harmonic patterns and use either the Potential Reversal Zone (PRZ) or the Pattern Completion Zone (PCZ) to determine key reversal and turning points.

Walk-forward genetic optimizations with at least 3-5 years of sample data should be used to ensure accurate forward results. Read our article for importing tick data on MetaTrader 4 & 5 here.

One consideration to note; volume tick data provided by brokers either real-time or historically are skewed since their liquidity providers typically do not give an accurate representation of the market’s depth. Therefor we have made this system based purely off price action with no reference to tick volume within any of the trend modifiers.

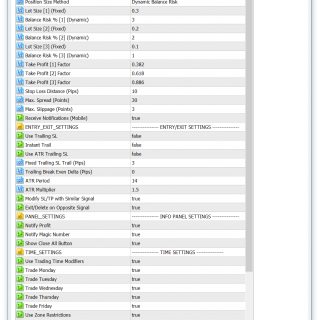

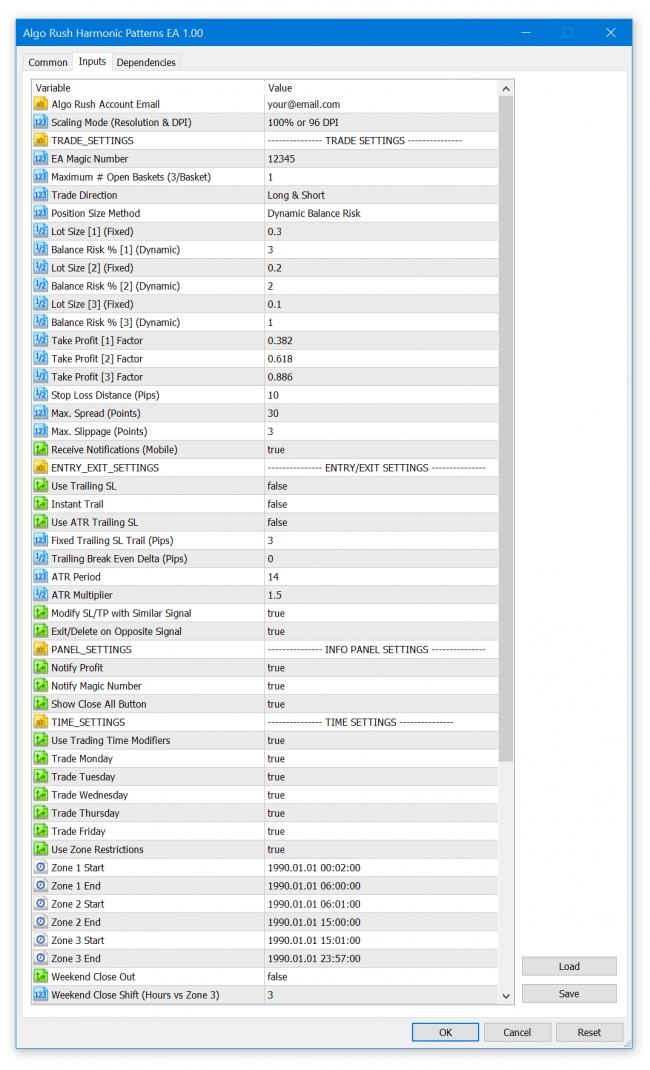

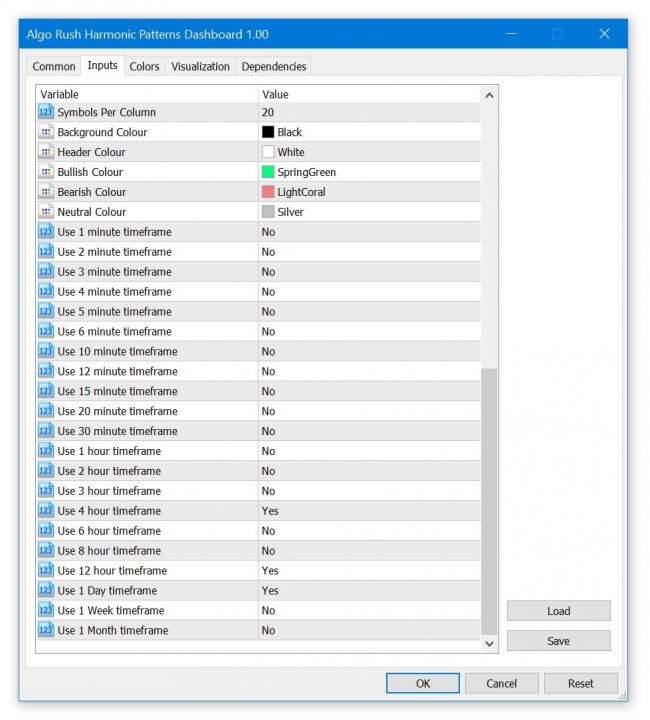

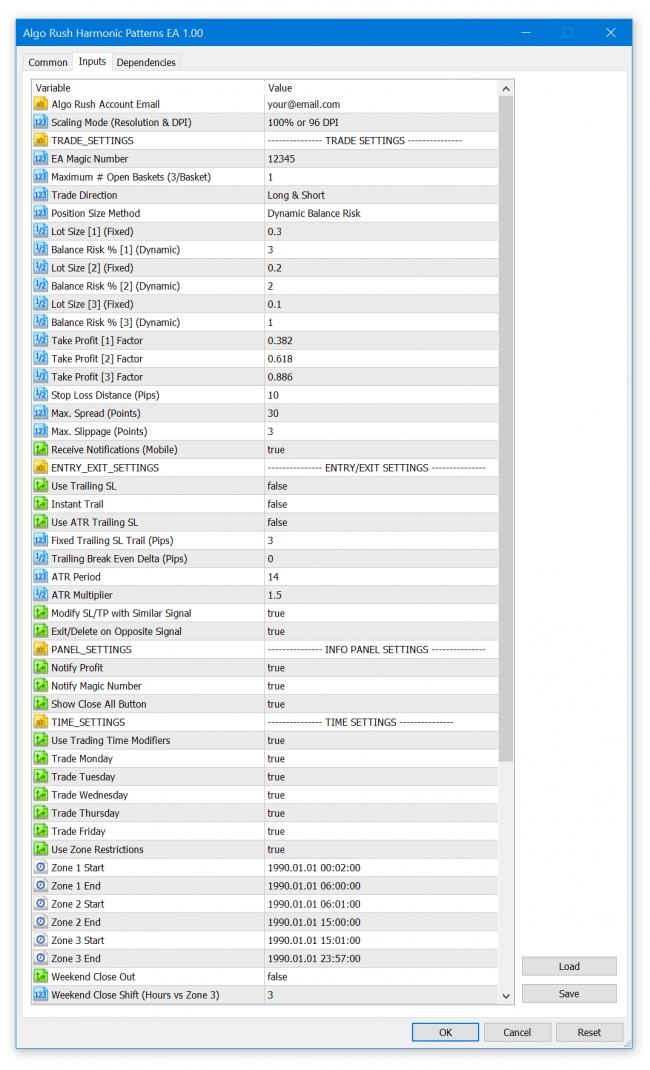

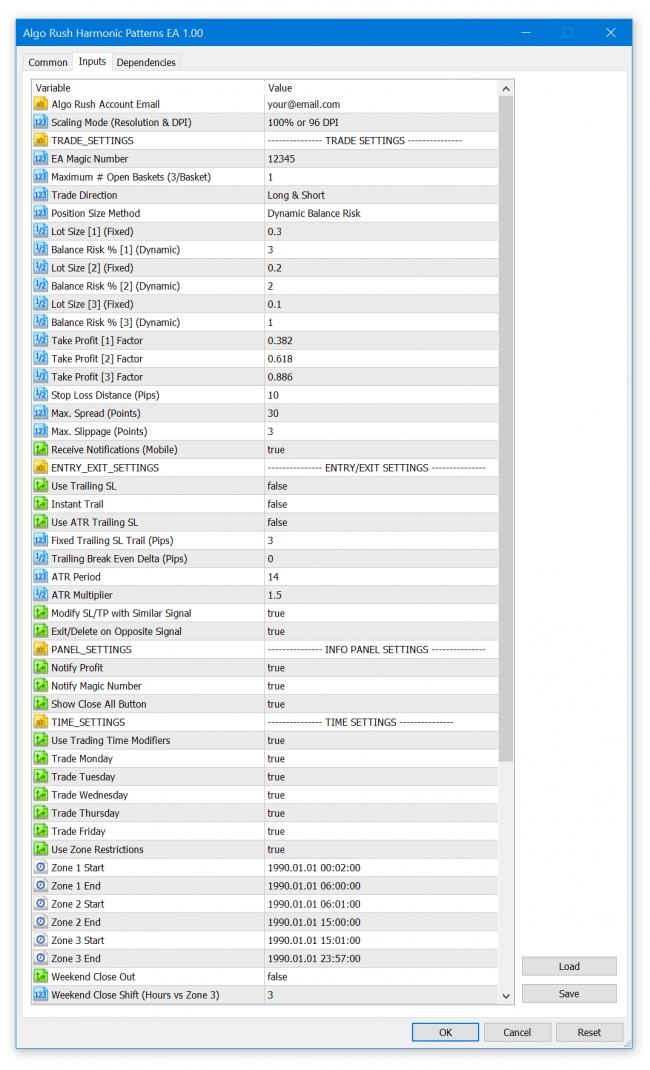

Harmonic Patterns Expert Advisor (EA) Settings on MetaTrader 4 & 5

Algo Rush Account Email

The email address that the active Algo Rush subscription is under.

- Note: The indicators and Expert Advisors will not initiate without an email address linked to an active subscription.

Scaling Mode (Resolution & DPI)

Users with either resolutions above 1080p (1920×1080) or DPIs above 96 will need to adjust the scaling mode settings to an option above the default 100% value. Adjusting this will resolve any issues with displaying objects such as text, buttons and windows within active charts.

- 100% or 96 DPI (default)

- 125% or 120 DPI

- 150% or 144 DPI

- 175% or 168 DPI

- 200% or 192 DPI

- 225% or 216 DPI

- 250% or 240 DPI

EA Magic Number

This number must be unique for every EA loaded. If the users forgets to change this, there will be errors within the MetaTrader client.

- Note: Any number such as 832855

Max. # Open Baskets (3/Basket)

The maximum number of baskets (signals) that can be open at the same time. Within a basket each position is one of the 3 TP levels. If only two out of the three TP levels are being used, then the basket will consist of two positions that have the same entry and their own TP levels.

- Default: 1

Trade Direction

This number must be unique for every EA loaded. If the users forgets to change this, there will be errors within the MetaTrader client.

- Long & Short (Default)

- Long Only

- Short Only

Position Size Method

The method used to allocate the amount used for each lot size within one trading setup.

- Dynamic Balance Risk (default)

- Fixed

Lot Size [1] (Fixed)

- Default: 0.3

Balance Risk % [1] (Dynamic)

- Default: 3

Lot Size [2] (Fixed)

- Default: 0.2

Balance Risk % [2] (Dynamic)

- Default: 2

Lot Size [3] (Fixed)

- Default: 0.1

Balance Risk % [3] (Dynamic)

- Default: 1

TP1 Factor

It’s first multiplier with fibo range for determining First take profit level.

- Default: 0.382

TP2 Factor

It’s second multiplier with fibo range for determining second take profit level.

- Default: 0.618

TP3 Factor

It’s third multiplier with fibo range for determining third take profit level.

- Default: 0.886

Stop Loss Distance (Pips)

You can increase SL level by increasing this value, it’s simply just additional pips to stop loss fib level.

- Default: 30

Max. Spread (Points)

- Default: 30

Max. Slippage (Points)

- Default: 3

Use Trailing SL

Must be enabled for any of the trailing options to work.

- Default: false

Instant Trail

When enabled, the trailing will begin early when ATR is activated before price reaches even TP1.

- Default: false

Use ATR Trailing SL

When enabled, the trailing will begin when ATR is activated rather than after TP1 or TP2.

- Default: false

Fixed T. SL Trail (Pips)

The fixed trailing stop loss in pips that is activated at Level C (default level for level C is 0.66 on the trend fib).

- Default: 0

Trail BE Delta (Pips)

The trailing breakeven offset that could be added to account for fees when adjusting the breakeven in pips.

- Default: 0

ATR Period

- Default: 14

ATR Multiplier

- Default: 1.5

Modify SL/TP with Similar Signal

Leave enabled to have your position’s take profit and stop loss updated when a new signal in the same direction is generated.

- Default: true

Exit/Delete on Opposite Signal

Leave enabled to have your long sell when a short signal confirms and vice versa.

- Default: true

Notify Profit

- Default: true

Notify Magic Number

- Default: true

Show Close All Button

Strongly recommended to have enabled.

- Default: true

Info Panel Pixel Shift

For resolutions higher than 1080p such as 2k, 4k, etc: 5-20.

- Default: 0

Use Trading Time Modifiers

- Default: true

GMT Open Hour

- Default: 0

GMT Open Minute

- Default: 1

GMT Close Hour

- Default: 23

GMT Close Minute

- Default: 59

GMT Close Minute (Friday)

Used when “Weekend Close Out” is enabled.

- Default: 57

Weekend Close Out

The position will close out before going into the weekend. Disable this option to have keep your position in an active during weekend closes.

- Default: false

Weekend Close Shift (Hours)

If “Weekend Close Out” is enabled, the position will close out starting from the minutes defined for the Friday (weekend) close minutes. To set the offset to one hour or more before, increase this value (defined in hours).

- Default: 3

References

https://algorush.com/wiki/harmonic-patterns-expert-advisor

https://algorush.com/trading-systems-for-metatrader/harmonic-patterns-expert-advisor/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Trading Systems

-

From: $19.99 / month with 1 week free trial

Potential Reversal Zone

What is the Potential Reversal Zone (PRZ)?

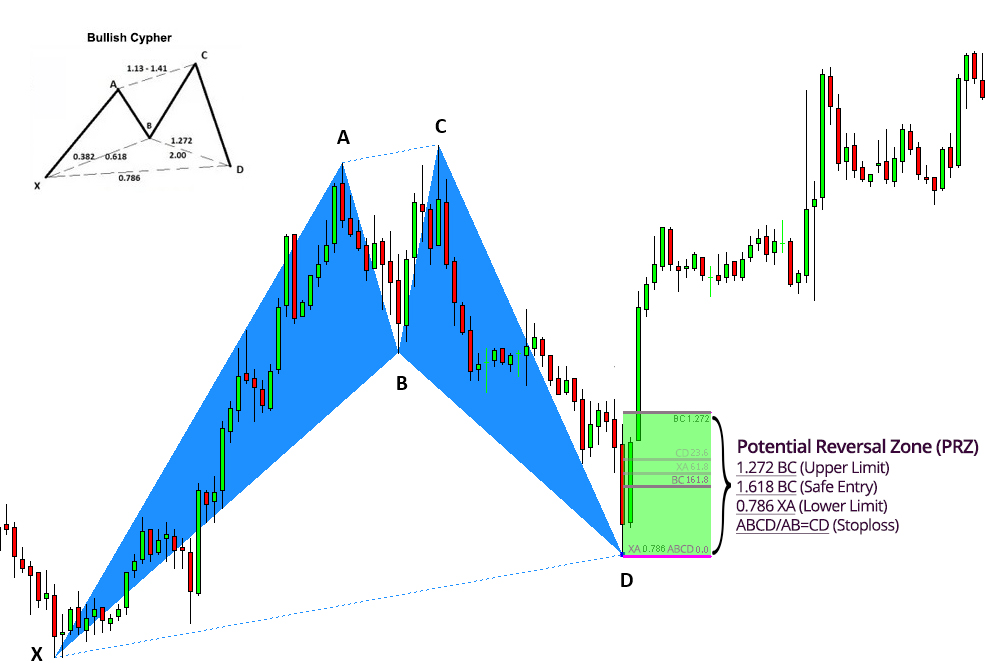

The PRZ, the Potential Reversal Area, is an area where 3 or more Fibonacci numbers converge, and where the harmonic pattern completes. It’s the D point on a harmonic pattern and where price has a high probability of reversing.

In the example below with the bearish Gartley pattern, the yellow rectangle is the PRZ where the Fibonacci projections (yellow and blue horizontal lines) for this pattern converge with other each other.

In the case of the bearish Gartley pattern the key Fibonacci projections to converge in the PRZ are the 0.786 XA, 1.27 BC, 1.618 BC and the level where AB=CD.

To illustrate a more in depth example, the Potential Reversal Zone (PRZ) for the Bullish Gartley pattern is constructed using the following Fibonacci extensions and projections:

-

-

- 0.78 XA

- 1.27 BC

- 1.62 BC

- AB = CD

-

Below illustrates the ratios for all legs and how they are used for determining a pattern’s PRZ.

Below is an example of real-world Potential Completion Zone (PCZ) formation:

References

https://patternswizard.com/5-0-harmonic-pattern/

https://harmonictrader.com/harmonic-patterns/5-0/

https://www.liteforex.com/blog/for-beginners/5-0-pattern-shark-hunt/

https://www.orbex.com/blog/en/2017/03/catch-key-reversals-5-0-pattern

https://algorush.com/trading-academy/advanced-lessons/harmonic-patterns/harmonic-trading-patterns/5-0-pattern/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Trading Systems

-

From: $19.99 / month with 1 week free trial

Pattern Completion Zone

What is the Pattern Completion Zone (PCZ)?

All harmonic patterns have a defined Pattern Completion Zone (PCZ) which are also known as price clusters that are formed by the completed swing (leg) at point D. The PCZ is the confluence of Fibonacci extensions, retracements and price projections for all legs within a harmonic pattern structure. Price action generally reverse within these patterns once the CD leg has been formed and confirmed. The price action’s reverse move from point D is what is known as the Pattern Completion Zone and any trades anticipated in this zone should be entered/closed based off the price reversal action levels displayed by the PCZ.

The Pattern Completion Zone (PCZ) is also referred to as the Potential Continuation Zone and is used on top of the Potential Reversal Zone (PRZ) methodology to predict future price movements from the structure’s confirmed D point instead of relying on generic Fibonacci retracement levels. The levels for the Pattern Completion Zone (PCZ) is constructed after the final point D is formed in the harmonic pattern’s structure. The levels which the PCZ produces are geared towards providing traders with potential key reversal and trend correction levels to use as maximum limits for take-profits and stoplosses.

The following Fibonacci retracements are used to construct the PCZ:

-

-

- XA

- BC

- CD

- AB=CD (applicable to XABCD/4-legged patterns only)

-

The Pattern Completion Zone (PCZ) is used by traders to help determine which levels to place take-profit and stoploss orders on while the the Potential Reversal Zone (PRZ) is used in calculating an approximate range to enter once the D point (4th leg) has been confirmed.

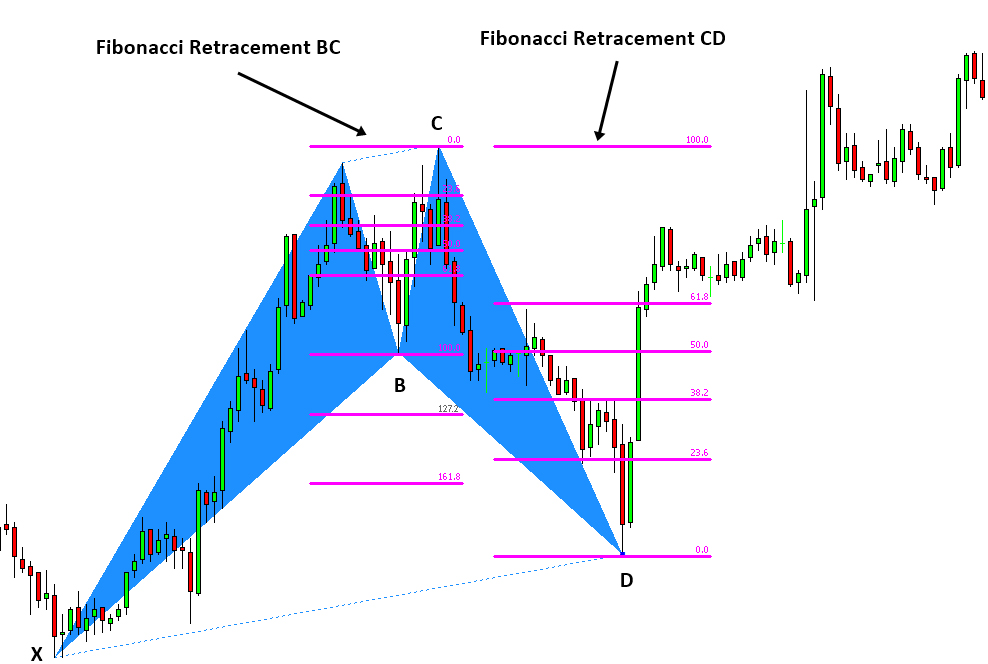

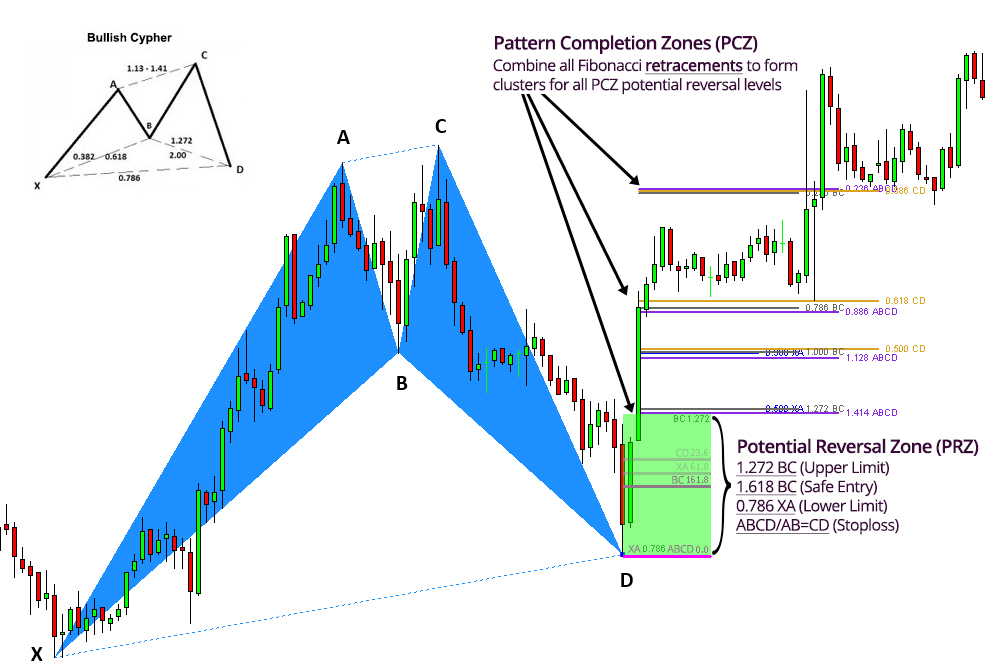

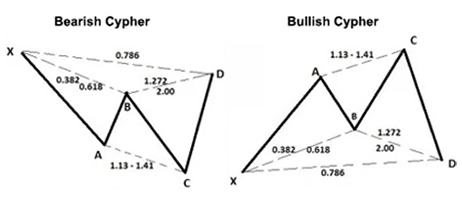

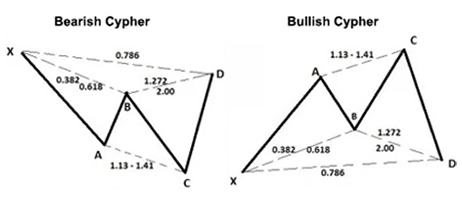

Example 1: Potential Reversal Zone on the Cypher Pattern

To demonstrate the PCZ, we will use a bullish Cypher to break down the retracements for each leg. Use the ratios from the diagram below when reading forward.

In the bullish Cypher example below, we will use the same PCZ retracement legs along with specific ratios. Some ratios within each of the legs listed below are used for the PRZ instead thus not being included in the diagram below.

Ratios used within each leg on the bullish Cypher pattern:

-

-

- XA (0.386, 0.500)

- BC (0.236, 0.786, 1.000, 1.272)

- CD (0.500, 0.618, 0.886)

- AB=CD (valid)

-

Once the Fibonacci retracements for XA, AB, BC and CD have been formed, their retracement levels (no extensions) can be combined then grouped into clusters which will help give traders a better understanding to where important levels of resistance or support may be waiting. It is also wise to set take-profit and stop loss levels on these cluster levels instead of relying on generic Fibonacci extensions (0.382, 0.618, 0.886) from point D.

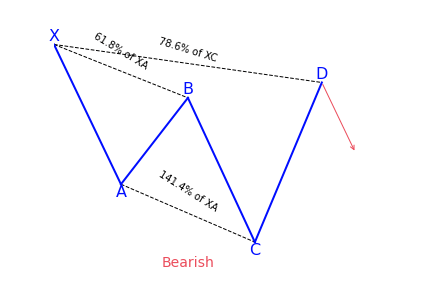

Example 2: Potential Reversal Zone on the bullish Alternate Bat

In this example we used the Alternate Bat pattern on the Harmonic Patterns Trading System. The PCZ retracement levels are projected as well the generic Fibonacci extension TP levels are also illustrated to show the difference between using clusters vs. using Fibonacci extension (0.382, 0.618, 0.886).

Note: we refrained from showing the PRZ in this example to illustrate what a projection with only PCZ levels looks like. As well consider that the lower PCZ levels are not accounted for when forming clusters.

PCZ ratios used within each leg on the Alternate Bat pattern:

-

-

- XA (0.386, 0.500)

- BC (0.386, 0.618, 0.886, 1.00)

- CD (0.386, 0.500, 0.618, 0.886)

- AB=CD (0.386, 0.500, 0.618)

-

References

https://www.tradingview.com/ideas/pcz/

https://www.futuresmag.com/2016/11/29/trading-abc-patterns

https://school.stockcharts.com/doku.php?id=trading_strategies:harmonic_patterns

https://algorush.com/trading-academy/advanced-lessons/harmonic-patterns/reversal-and-turning-point-methods/pattern-completion-zone-pcz/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Trading Systems

-

From: $19.99 / month with 1 week free trial

5-0 Pattern

What is the 5-0 harmonic pattern?

Just as it is with the shark pattern, the 5-0 harmonic pattern is a relatively new pattern discovered by Scott Carney. Carney spoke about this pattern in the second book in his harmonic series, ‘Harmonic Trading: Volume Two’.

The 5-0 pattern is easily one of the wonkiest looking patterns. Depending on the amount of knowledge you have about harmonic patterns, the 5-0 will look different, and this is mainly because the 5-0 pattern begins a 0. If you are familiar with seeing XABCD, then 0XABCD will undoubtedly look different.

Key takeaways:

- The 5-0 pattern is a reversal harmonic pattern.

- It follows specific fibonacci ratios (which you can read more below)

The patterns are relatively new but are getting more popular lately. It stands out from the other harmonic patterns because it is meant to begin a new trend rather than discover retracement. There are two types of this pattern, bullish and bearish.

The convergence zones discovered with the help of the shark pattern makes it possible for us to accurately detect the rebound but doesn’t necessarily lead to the restoration of the previous trend. On the other hand, regular rollbacks aim to determine the ability of the forces dominant on the market in the previous period (bears or bulls) to get the initiative back to their disposal. If they are not sufficient, the last reversal of the previous trend occurs, but already within another pattern – 5-0 harmonic pattern.

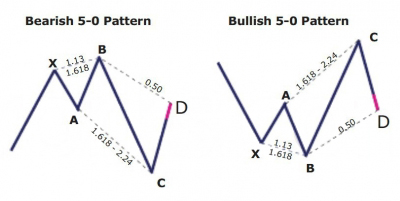

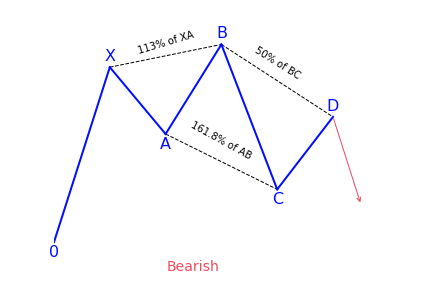

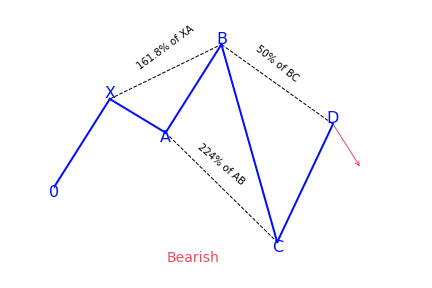

How to identify the 5-0 pattern?

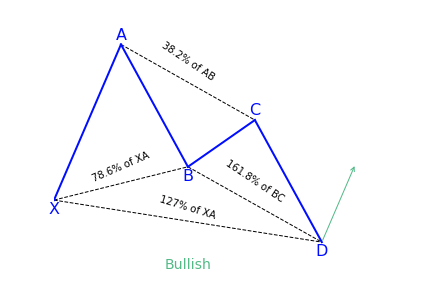

The 5-0 pattern begins with either an uptrend or a downtrend which gets exhausted and draws zigzag like corrective movements. The qualities of the 5-0 pattern to look at include:

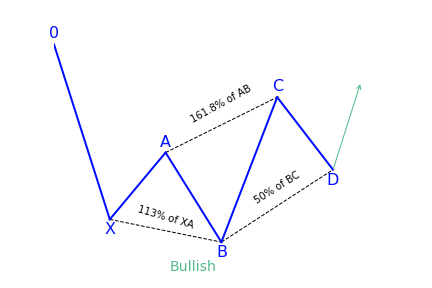

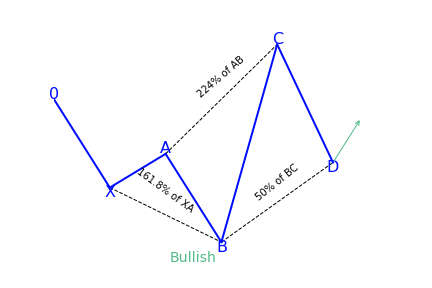

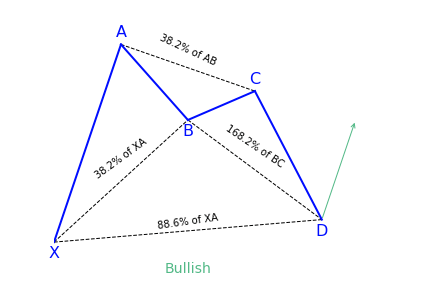

- AB movement has to be 1.13 to 1.618 retracement of XA.

- BC movement has to be 1.618 to 2.24 retracement of an AB.

- CD movement ought to be 0.5 retracements of BC

- C should be between 0.886 and 1.13 of 0X movement

If the conditions are satisfied, some traders trade the last leg of CD. They entering at C with a stop below 2.24 of AB retracement and aiming at 50 percent correction of BC movement.

The 5-0 harmonic pattern is traded when the price is getting to point D. The stop-loss is positioned a few ticks below/above the farthest possible D level. Unlike a lot of the other patterns, 5-0 doesn’t have specific targets because it usually begins a new trend. Here the pattern fib ratios don’t matter much. Entries might be done with a limit order or on price reversals away from point D. All entries have to be confirmed for risk/reward ratio. Entries having less risk/reward have to be taken cautiously or discarded altogether.

A reliable indicator should automatically scan for, recognize, display, and alert emerging 5-0 and other harmonic chart patterns. It indicates the name of the pattern, when it happened, and the stop price. The pattern scanner goes through various charts in the same period and assists traders to find trading opportunities as soon as they come up.

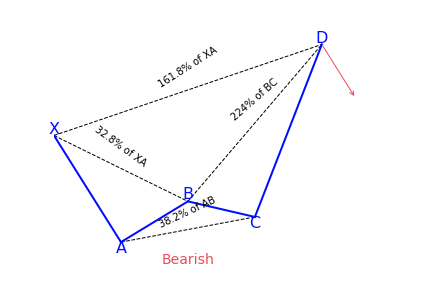

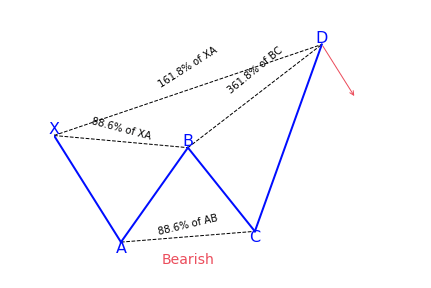

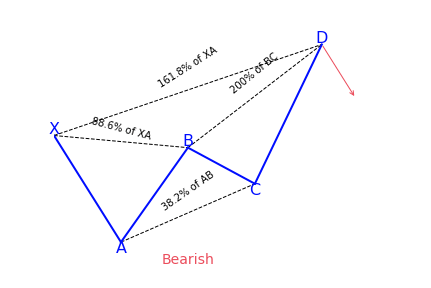

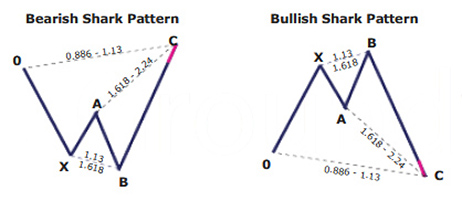

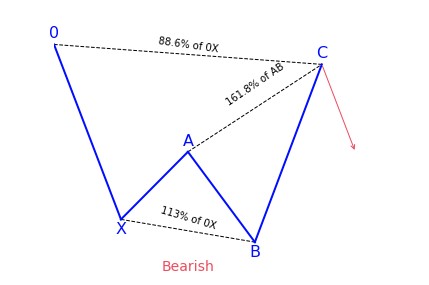

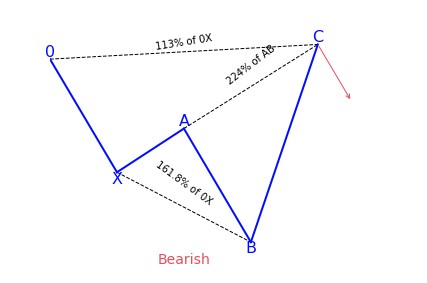

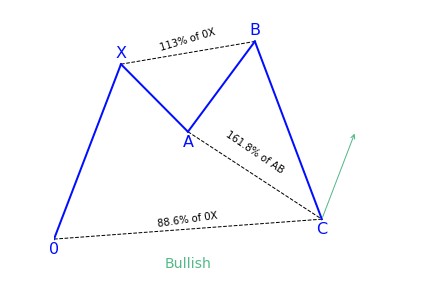

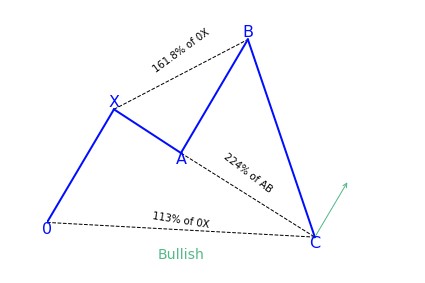

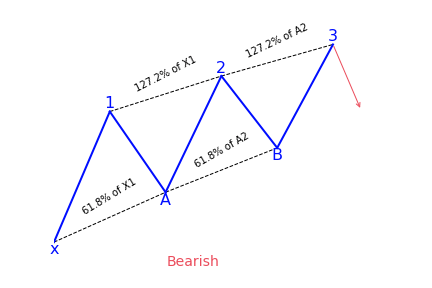

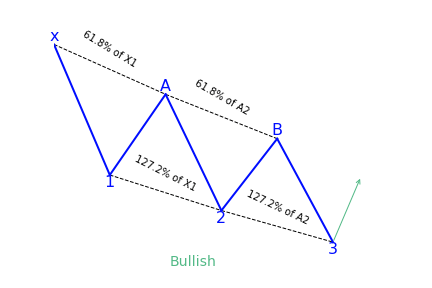

Bearish 5-0 pattern

To correctly identify the bearish 5-0 pattern, first, find the shark pattern, wait for the implementation of its targets at 88.6 or 113 percent, and the following rollback in the direction of 50 percent of the BC wave. The length of this wave in both graphic configurations is 161.8 to 224 percent of AB. If after the convergence zones of the shark pattern is reached, a correction in the direction of 23.6 percent, 38.2 percent, or 50 percent has followed, we can talk about the transformation of the real pattern into 5-0.

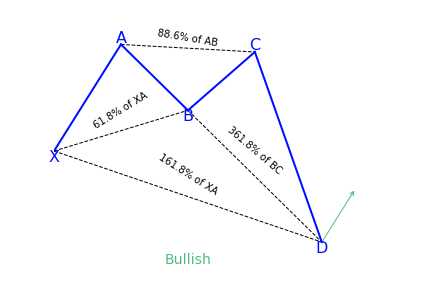

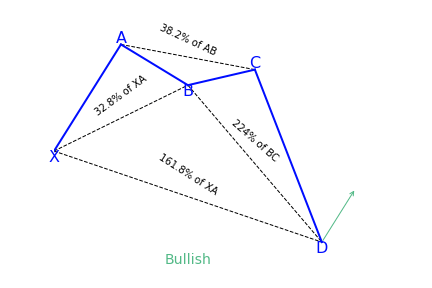

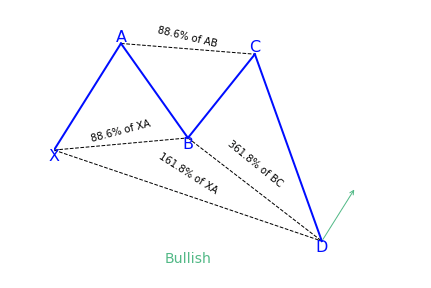

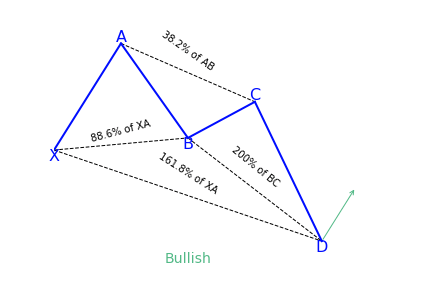

Bullish 5-0 pattern

After the target at 113 percent of the shark harmonic pattern was achieved, it was followed by a rollback in the direction of 38.2 percent of the CD wave. The trader has to search for this place for confirmation signals to create a long position. It can be both indicators, prompts from price action, or other items and techniques used for technical analysis.

What does the 5-0 pattern tell traders?

The 5-0 harmonic chart pattern suggests a long entry upon completion of the pattern or confirmation of the D point of the pattern. The pattern is a unique 5-point reversal structure that typically shows the first pullback of an important trend reversal. It is a relatively new pattern that has 4 legs and particular Fibonacci measurements of each point within the structure, creating room for better flexible interpretation. The Potential Reversal Zone (PRZ) is described differently from other harmonic chart patterns.

Conservative traders look for more confirmation before getting into a trade. Targets for this pattern can be placed at the discretion of the trader as the reversal point could be the beginning of a new trend. Common stop-loss levels are found behind a structure level beyond the D point or the next vital level for the Fibonacci sequence.

How to trade when you see the 5-0 pattern?

One of the best processes of interpreting this pattern is to look at it from a tired and frustrated trader’s point of view. Taking the bullish 5-0 pattern as an example, then we can see why. The AB leg ends with B below X, making a lower low. We then get a longer move in time where the BC leg is the most prolonged move with C ending over A.

The movement from B to C may look like a bear flag or bearish pennant. C to D indicates intense shorting pressure and a belief among bears that new lows are on the way. Rather, we get to D – the 50 percent retracement of BC. Rather than new lower lows, we get a confirmation swing forming a higher low. That move will most probably create a brand new trend reversal or significant corrective move.

The elements of trading the 5-0 pattern

- The pattern starts (with 0) at the beginning of a long price move

- After 0 has formed, an impulse reversal at X, A, and B should have a 113 to 161.8 percent extension

- The projection off of AB has a 161.8 percent extension requirement to C. C can extend beyond the 161.8 percent extension but not beyond 224 percent.

- D is the 50 percent retracement of BC and is same as AB

- The reciprocal AB=CD is needed

Drawing the 5-0 pattern properly

To perfectly draw or locate a 5-0 harmonic chart pattern on the price chart, first of all, we need to locate the X and A points of the pattern. The X point is seen at the bottom of a strong bearish trend. The A point is found at the top of a bullish trend. The next thing traders need to do is to draw a Fibonacci retracement tool from X to A to determine the B point of the chart pattern. The B point should be within the 113 percent to 161.8 percent Fibonacci retracement of XA.

In the last step, we will get the entry point, D point, of the 5-0 harmonic chart pattern. To get the D point of the pattern, draw a Fibonacci retracement tool from B to C. The D point has to be at the 50 percent Fibonacci retracement of BC.

Traders can be sure when the D point of the pattern is confirmed. The stop-loss for the order should be set at the lower support level. The profit target for the order should be placed within the 50 to 88.6 percent Fibonacci retracement of CD.

The C axis can also be traded, if it is the D point of a bearish harmonic chart pattern. The B point can be traded if the entries are confirmed by the other tools for technical analysis.

References

https://patternswizard.com/5-0-harmonic-pattern/

https://harmonictrader.com/harmonic-patterns/5-0/

https://www.liteforex.com/blog/for-beginners/5-0-pattern-shark-hunt/

https://www.orbex.com/blog/en/2017/03/catch-key-reversals-5-0-pattern

https://algorush.com/trading-academy/advanced-lessons/harmonic-patterns/common-harmonic-patterns/5-0-pattern/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Trading Systems

-

From: $19.99 / month with 1 week free trial

AB=CD Pattern

What is the AB=CD (ABCD) harmonic pattern?

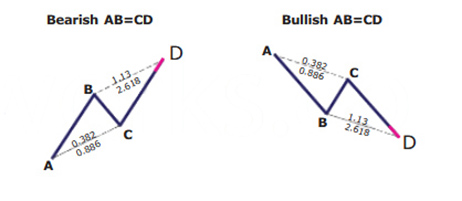

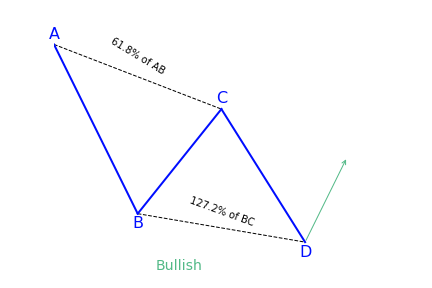

Created by Larry Pesavento and Scott Carney, after being discovered originally by H. M. Gartley, the AB=CD trading pattern has become very effective as a trading technique for technical traders. This trading pattern helps you to identify when the price is about to change direction. The idea is that you can purchase when the price is low and about to rise or sell when the price is high and is about to go down. It is a well-known harmonic group of patterns. Some traders sometimes also refer to it as ABCD pattern.

Key takeaways:

- The AB=CD harmonic is reversal pattern

- Depending on the context, it can be bullish or bearish

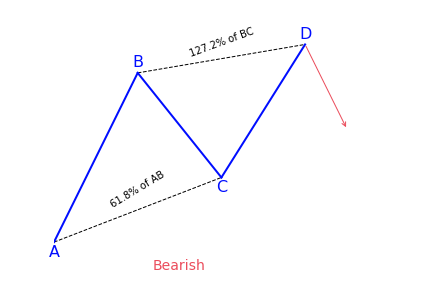

- It should follow specific Fibonacci ratios :

- BC is the 61.8 percent Fibonacci retracement of AB

- CD is the 127.2 percent Fibonacci extension of BC

The AB=CD pattern is considered the simplest harmonic pattern because it has significantly less requirements than most of the other harmonic setups. In addition to that, the AB=CD formation is much easier to detect on the price chart.

After weeks of research, back testing and live trading, experts feel comfortable to recommend this setup to traders.

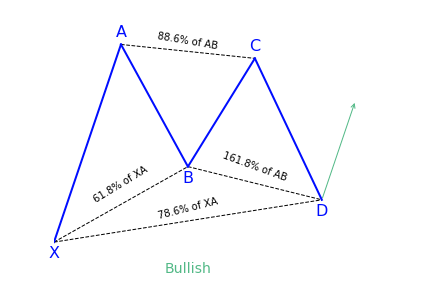

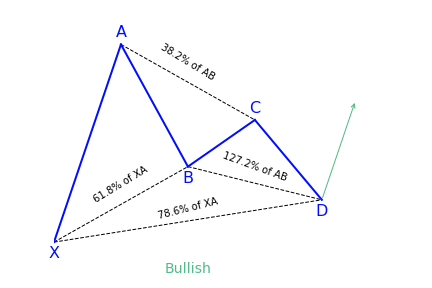

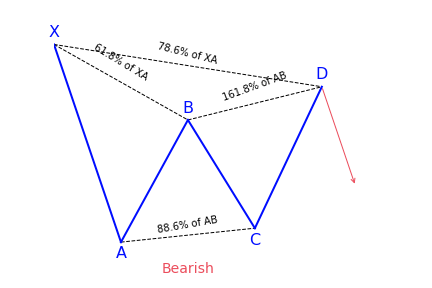

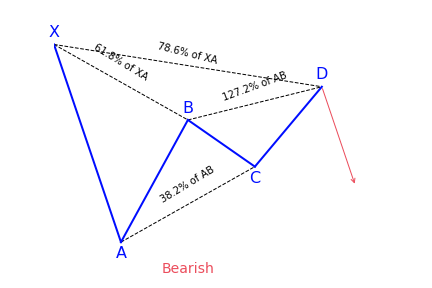

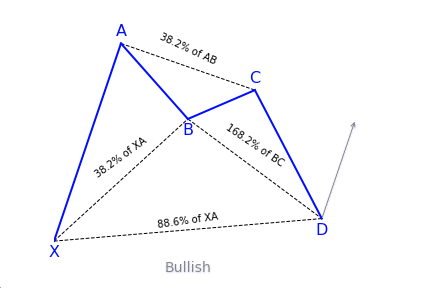

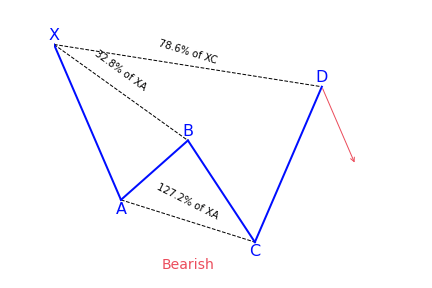

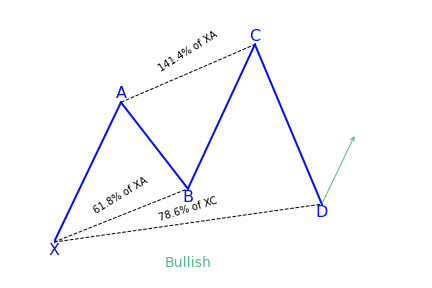

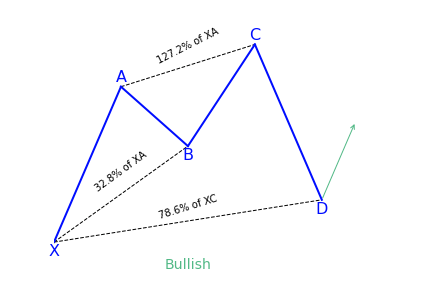

There are two types of AB=CD (ABCD) patterns

There are two types of AB=CD trading patterns – the bullish AB=CD and the bearish AB=CD.

Bullish AB=CD (ABCD)

This pattern begins with a decrease in price (AB), followed by a reversal and a rise (BC). The BC move then reverses into a new bearish move (CD), which goes below the bottom made at point B. It is expected that there will be a reversal and an increase in price after the price completes the CD move.

Bearish AB=CD (ABCD)

This chart pattern is the same as the bullish AB=CD pattern, but it is upside down. The pattern starts with a bullish AB line, which can be reversed by a new bearish move. The BC move then gets reversed by a new bullish move, which goes above the top point. After noticing these qualities, traders can expect the price to reverse again, creating a new bearish run.

How does Fibonacci Ratios integrate with the pattern?

This pattern needs to conform to particular Fibonacci ratios. Usually, there are two Fibonacci rules associated with the ABCD figure:

- BC is the 61.8 percent Fibonacci retracement of AB

- CD is the 127.2 percent Fibonacci extension of BC

When trading the ABCD pattern, always conform to the Fibonacci levels. There are various indicators to assist you in confirming the patter requirements.

What does the AB=CD (ABCD) trading pattern tell traders?

Usually, the price action behavior of the ABCD pattern begins with the price going in a new direction A, which later creates a swing level B, then retraces a portion at C, and finally resumes to take out the important swing at the second position. It continues until it gets to a distance equivalent to AB or D. When the CD portion gets to an equivalent distance to AB, it is expected that there will be a reversal of the CD price move. At the same time, BC and CD will respond to particular Fibonacci levels.

When there’s a confirmation of AB=CD pattern, traders look to set entry points on the chart at the beginning of the emerging reversal after the CD move. The idea is to enter the market early enough with a trading position just after the reversal of the CD move.

How to trade the AB=CD (ABCD) harmonic trading pattern?

General principle

Trading the ABCD pattern involves rules meant to guide people on how to enter trade, lock potential profits and exit with minimum loss if the market follows the opposite direction. The entry of a trade, whether buy or sell, triggers when the pattern is in place.

After the AB=CD harmonic pattern has been identified, you can start looking for a trading opportunity at point D. The buy and sell signals are generated after the final C to D leg, when a reversal is expected to occur. If the pattern is trending higher, traders can look to sell or enter a short position at point D. If the pattern is trending lower, it is advisable to buy the security at point D in anticipation of a turnaround.

Protect your trade

It is best to place stop-loss points just above or below point D, depending on the direction of the trade. If the move goes beyond that point, the chart pattern is invalidated and the reversal is less likely to happen. Take-profit points are placed by using the Fibonacci levels. For instance, traders might look for a move back to the original point A and move a trailing stop-loss to 28.2, 50, and 61.8 percent Fibonacci levels along the way.

Follow your strategy

Just as it is with other technical analysis, the AB=CD chart pattern best works when used along with other chart patterns or technical indicators. Also make use of volume as a confirmation of a reversal once the AB=CD pattern makes a prediction.

Study the chart looking at the highs and lows of the price. Observe the price as it forms AB and BC. For a bullish ABCD pattern, C has to be lower than A and should be the intermediate high after the low at B. Point D has to be a new low below B.

When the market gets to a point where D may be found, don’t rush into a trade. Make use of some techniques to ensure that the price reversed up, or down for a bearish ABCD. The best scenario is a reversal candlestick pattern. You can set a buy order at or over the high of the candle at point D.

Setting a profit target for your trade

One way of deciding where to take profits is by drawing a new Fibonacci retracement point from A to D of the pattern. If you are not sure the point to place your profit, set it at the 61.8 percent level, but closely observe how the price reacts around the levels. If the price finds it difficult to break through any of them, close your trade and take an early profit.

Summary

The AB=CD pattern is one of the most popular harmonic patterns. Since it often appears in practice, traders can use it together with other kinds of technical analysis to improve their chances of success. The secret is matching up Fibonacci levels and setting the right stop-loss and take-profits points to manage the trade. Since their appearance in 1935, harmonic patterns have gained momentum lately and have gone through several refinements. The addition of Fibonacci ratios and projections has given the specifications more detail.

References

https://patternswizard.com/abcd-harmonic-pattern/

https://learn.tradimo.com/advanced-chart-patterns/ab-cd-pattern

https://www.babypips.com/learn/forex/the-abcd-and-the-three-drive

https://www.forex.com/en/education/education-themes/technical-analysis/abcd-pattern/

https://algorush.com/trading-academy/advanced-lessons/harmonic-patterns/common-harmonic-patterns/abcd-pattern/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Trading Systems

-

From: $19.99 / month with 1 week free trial

Alternate AB=CD Pattern

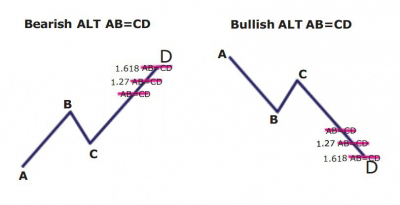

What is the Alternate AB=CD (ABCD) harmonic pattern?

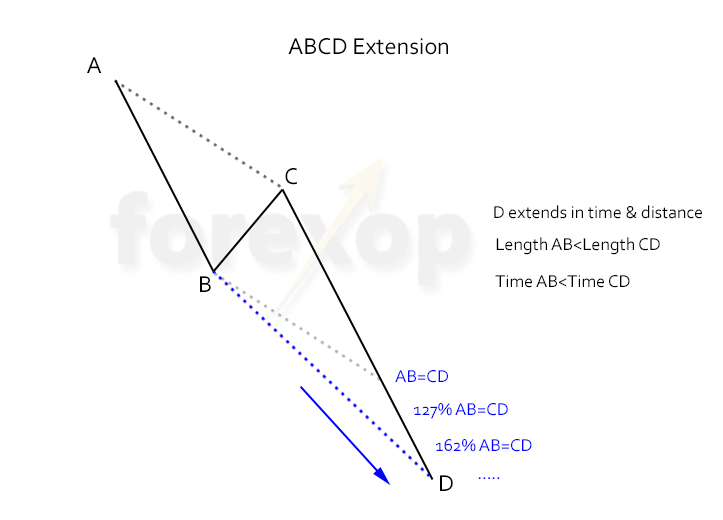

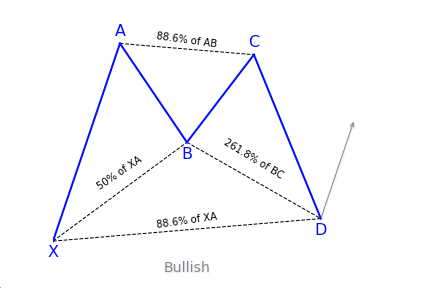

Many times ABCD patterns are not perfectly symmetrical or even close to. These are alternate ABCD patterns. The CD leg can be shorter or longer than the AB leg. But usually the CD leg is longer – these are called ABCD extensions. The Alternate AB=CD (also known as the Alternate ABCD) is an extension pattern which consists of 3 Fibonacci extension levels.

In an ABCD extension the retracement at D extends further than anticipated. The extension can be in time or price, but usually it’s both.

The common ABCD extension ratios are:

- CD = 127% x AB

- CD = 162% x AB

- CD = 262% x AB

When there’s an ABCD extension a bullish market makes higher highs than anticipated by the ideal pattern. In a bearish trend it’s the opposite, and the trend makes lower lows than otherwise predicted.

When checking an ABCD extension, anticipate higher volatility around point D.

Start Harmonic Trading

Learn Harmonic Patterns

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Gartley Pattern

What is the Gartley harmonic pattern?

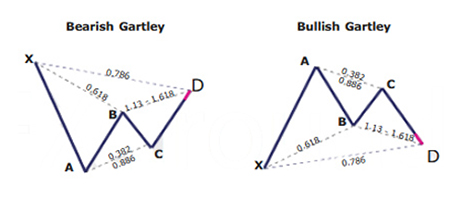

The Gartley pattern is the most commonly used harmonic pattern that is based on Fibonacci numbers and ratios. This pattern offers assistance to traders in identifying reaction highs and lows. H.M. Gartley laid down the foundation for harmonic chart patterns in 1932 in his book ‘Profits in the Stock Market’.

A harmonic pattern operates on the basis that Fibonacci sequences can be applied in building geometric structures, like retracements and breakouts in prices. The Fibonacci ratio is common in nature. It has become a famous area of focus among technical analysts that use tools.

Key takeaways:

- The Gartley pattern is a 4-legged harmonic pattern

- It can be bullish or bearish

- It follows clear Fibonacci levels (see the Gartley ratios paragraph for detail)

This is one of the most traded patterns. It is a retracement and continuation pattern that is formed when a trend temporarily changes direction before continuing in its original direction. It provides a low-risk opportunity for traders to go into the market where the pattern finishes and the trend comes back.

How to identify the Gartley pattern?

The Gartley pattern depends on various labeled points within a general movement in price. Most Gartley patterns are for overall bullish trends (as the point from X to A is moving upwards) that is currently experiencing a bearish retracement.

Since the pattern is a member of the Harmonic family, every swing has to conform to particular Fibonacci levels. We will now look at each component of the Gartley structure.

The Gartley Pattern Structure: Important Movements

X to A

The movement begins with X to A and there are no specifics for identifying the X to A leg of the Gartley pattern. In its bullish version, this first leg gets formed when the price sharply rises from point X to point A. This is the longest leg of the pattern.

A to B

This is where Fibonacci becomes relevant to the pattern. The distance between A and B should be close the size of the movement from X to A. The A-B leg will not retrace pass point X – if it does, the pattern is considered invalid.

B to C

This movement should be a retracement of 38.2% or 88.6% of the movement of A to B. If the B to C move retraces above point A, the Gartley pattern is void.

C to D

This should be an extension of the B to C leg. The difference when trading this pattern is that you will place your trade entry at the point where the C to D leg has achieved a high percentage retracement of the X to A leg.

A to D

After the completion of C-D, traders should measure the overall movement of A to D. It should be a 78.6 percent retracement of the change in price of X to A.

Bullish and bearish Gartley pattern variations

The bearish version of the Gartley pattern is just the opposite of the bullish pattern. It shows a bearish downtrend with several price targets when the pattern reaches completion by the fourth point.

What does the Gartley pattern tell traders?

A lot of technical analysts make use the Gartley harmonic pattern together with other chart patterns or technical indicators. For instance, the pattern can give a big picture overview of where the price is likely to go over the long-term. In the meantime, traders focus on executing short-term trades in the direction of the predicted trend. The breakout and breakdown price targets may also be used as support and resistance levels by traders.

The best part about these types of chart patterns is that they give particular knowledge about both the timing and magnitude of price movements rather than just look at one or the other.

Just as it is with other chart patterns, there is a bullish and a bearish version. The Gartley harmonic pattern includes the AB=CD pattern, this means that it is necessary for traders to study it before making any decision. The pattern is often known to as Gartley222 because Gartley first described it on page 222 of his book.

How to enter into a trade when you see the Gartley Pattern

To enter a Gartley trade you should first take note of the pattern and then confirm if it is valid or not. Outline the four price swings on the chart and check to make sure they respond to their respective Fibonacci levels to draw the Gartley pattern on your chart. Ensure you mark every price action swing with the important letters X, A, B, C, and D. By doing this, you will be able to estimate the overall size of the pattern and get a clear idea about the parameters.

If your chat is a bullish Gartley, open a long trade after noticing these conditions:

- CD gets support at 127.2 percent or 161.8 percent Fibonacci level of the BC move.

- The price action bounces in a bullish direction from the respective Fibonacci level.

If the Gartley pattern is bearish, then you make use of the same two rules to open a trade. But in this case, your trade will to the short side.

Where to set your stop-loss for a Gartley trade?

It is always recommended that you use a stop loss order regardless of your preferred entry signal. By doing this, you will be protecting yourself from any rapid or unexpected price moves. The stop loss order of a bullish Gartley trade should be found below the D point of the chart pattern. But for a bearish Gartley trade, your stop loss order should be found above the pattern’s D point.

What to aim for your take profit for a Gartley trade?

When you open your Gartley trade and you place your stop loss order, you expect the price to move in your favor, right? And if and when it does, you should know how long you expect to stay in the trade.

It is advisable to enter a full position after the D bounce and then scale out at different levels when trading a Gartley harmonic pattern. If the price momentum continues to show signs of strength, you can opt to keep a small portion of the trade open so as you can catch a large move. Use price action clues such as trend lines, support and resistant techniques, candle patterns and trend lines to find the right final exit point. But generally, if the price action shows no signs of interrupting the new trend, just stay in it for as long as you can.

References

https://www.investopedia.com/terms/g/gartley.asp

https://patternswizard.com/gartley-harmonic-pattern/

https://learn.tradimo.com/advanced-chart-patterns/gartley-pattern

https://www.babypips.com/learn/forex/the-gartley-and-the-animals

https://forextraininggroup.com/trading-the-gartley-pattern-ratios-rules-and-best-practices/

https://algorush.com/trading-academy/advanced-lessons/harmonic-patterns/common-harmonic-patterns/gartley-pattern/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Trading Systems

-

From: $19.99 / month with 1 week free trial

Bat Pattern

What is the Bat harmonic pattern?

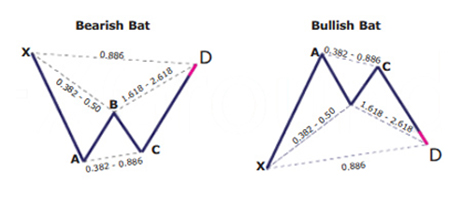

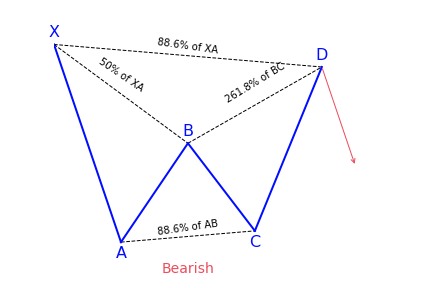

The Bat harmonic pattern is close to the Gartley pattern. It is a retracement and continuation pattern that comes up when a trend temporarily changes its direction but then continues on its original course. The pattern is a 5-point retracement structure that was discovered in 2001 by Scott Carney. It has particular Fibonacci measurements for every point within its structure. It is necessary to note that D is not a point, but rather a zone in which price is probably going to reverse. This zone is known as the Potential Reversal Zone (PRZ).

Key takeaways:

- The Bat harmonic pattern is a reversal pattern.

- It follows specific Fibonacci ratios (see below for more)

The B point retracement of the primary XA leg has to be lower than a 0.618, preferably a 0.50 or 0.382. The PRZ is made up of 3 converging harmonic levels:

- 0.886 retracement of the primary XA leg

- Extended AB=CD chart pattern, mostly 1.27 AB=CD

- Minimum BC projection is 1.618

The first target might be the 382 retracements of AD and the second target the 618 retracements of AD. A popular stop-loss level would be behind the X-point. Conservative traders may wait to get additional confirmation before trading. Bat patterns can be bearish and bullish.

How to identify the Bat harmonic pattern with Fibonacci

The bat harmonic pattern follows different Fibonacci ratios. One of the major ways to differentiate it from a Cypher pattern is the B point which, if it doesn’t go above the 50 percent Fibonacci retracement of the XA leg then it is a bat, otherwise it can turn into a cypher structure.

The market strategy of the pattern is suitable for all time frames and all markets types. Traders have to keep in mind that on lower time frames using the bat pattern market strategy has some challenges because the pattern tends to appear on less frequent on lower time frames.

The Bat pattern is a 4 legged pattern

As mentioned earlier, the bat harmonic pattern looks very similar to the Gartley pattern. It has four different legs marked as X-A, A-B, B-C, and C-D.

- X-A: In its bullish version, the first leg appears when the price sharply increases from point X to point A. This is the longest leg of the pattern.

- A-B: The A-B leg then sees the price switching direction and retracing 38.2 to 50 percent of the distance covered by the X-A leg. Have it in mind that the A-B leg can never retrace beyond point X. But if it does, the pattern is considered invalid.

- B-C: Here, the price changes direction for a second time and moves back up, retracing anything from 38.2 to 88.6 percent of the distance covered by the A-B leg. If it retraces up above the high of point A, the pattern is considered invalid.

- C-D: This is the last and most significant aspect of the pattern. As with the Gartley pattern, this is where the bat harmonic pattern ends and traders place their long (buy) trade at point D.

However, with the bat pattern, traders look to place their entry trade order at the location where the C-D leg has reached an 88.6 percent retracement of the X-A leg. Ideally, point D should also represent a 161.8 to 261.8 percent extension of the B-C leg.

What does the Bat pattern tell traders?

It offers traders the opportunity to enter the market at a good price, just as the pattern completes and the trend resumes. The main difference of the bat pattern to the Gartley pattern is where it completes – at an 88.6 percent Fibonacci retracement of the X-A leg. Its inner retracements are also slightly different.

The harmonic bat pattern teaches traders how to trade the bat pattern and begin earning money with a new exciting approach to technical analysis. The market strategy of the pattern is part of the harmonic trading patterns system of trading. Just as it is with many harmonic patterns, there is a bullish and a bearish version of the bat pattern.

How to trade when you see the Bat pattern?

Before trying and trading the pattern, confirm from this checklist that the pattern is real. It should include these vital elements:

- An AB=CD pattern or an extension of this pattern

- An 88.6 percent Fibonacci retracement of the X-A leg

- A 161.8 to 261.8 percent Fibonacci extension of the B-C leg

Next will be to look at how traders can trade using the bat pattern. We will make use of the bullish bat pattern as an example. For a bearish bat pattern, simply do the opposite for your orders.

The first thing to look for when looking for this pattern is the impulsive leg or the XA leg. We are trying to identify a strong move up or down depending if we either have a bullish bat or a bearish bat pattern.

The next thing that needs to be satisfied for an authentic bat pattern structure is a minimum 0.382 Fibonacci retracement of the XA leg and it can go as deep as 0.50 Fibonacci retracement of the XA leg, but it cannot break below the 0.618. This will form the B leg of the pattern.

The next thing traders should do is to look for a retracement of the AB leg up to at least 38.2 percent Fibonacci ratios, but it cannot exceed the 88.6 percent, and this will form the third point C of the pattern strategy.

The last thing to do is to establish is the D point, and to get to the D point, find the 0.886 Fibonacci ratios of the impulsive XA leg, which will lead to a deep CD leg, and finally, it will complete the entire structure of the pattern.

Market strategy with the Bat pattern

The market strategy of the pattern has been tested across various classes of assets (commodities, currencies, stocks, and cryptocurrencies). It is recommended that traders should take the time and back-test the bat harmonic patterns strategy before using this advanced pattern for trading.

Step 1: Drawing the pattern

- Begin by clicking on the bat pattern indicator that is found on the right-hand side toolbar

- Identify the beginning point X, which can be any swing high or low point on the chart

- After identifying the first swing high/low point, simply follow the market swing wave movements

- You should get 4 points or 4 swings high/low points that join and form the harmonic bat pattern strategy

Step 2: Trading the pattern

The 88.6 percent Fibonacci ratio provides traders a more reliable risk/reward ratio which is why the market strategy of the bat pattern is such a very popular as a market strategy. The best entry point is the 88.6 percent Fibonacci retracement which is a very accurate market turning point.

It is recommended that traders should enter as soon as they touch the 88.6 percent figure. Oftentimes the harmonic bat pattern strategy doesn’t go much above this level.

Step 3: Placing a stop-loss

Usually, traders should place their protective stop-loss lower than the point X of a harmonic bat pattern. That is the only logical location to hide the stop-loss because any break below will automatically invalidate the pattern.

Step 4: Take-profit margin

There can be several ways to manage your trades, but the best target for this pattern should be to use a multiple take profit formula. For this pattern strategy, take the first partial profit once you hit wave-C level and the remaining half once we break above wave-A.

By doing this you will accomplish two things:

- first, you’ll ensure that you accumulate profits,

- and secondly if the markets reverse, you ensure you’re stopped at BE and don’t lose any money.

References

https://forexop.com/harmonics/bat/

https://patternswizard.com/bat-harmonic-pattern/

https://www.profitf.com/articles/patterns/harmonic-pattern-bat/

https://www.investopedia.com/articles/forex/11/harmonic-patterns-in-the-currency-markets.asp

https://algorush.com/trading-academy/advanced-lessons/harmonic-patterns/common-harmonic-patterns/bat-pattern/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Trading Systems

-

From: $19.99 / month with 1 week free trial

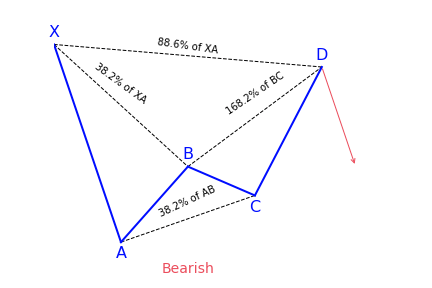

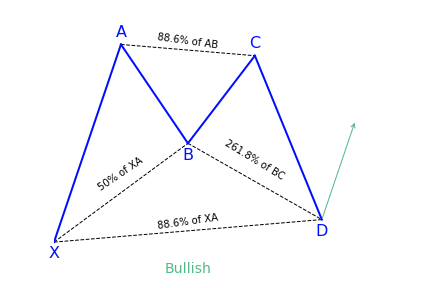

Alternate Bat Pattern

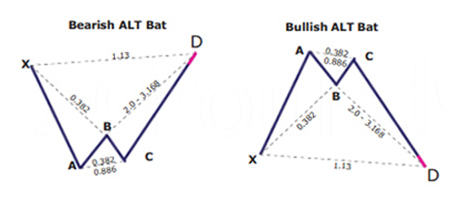

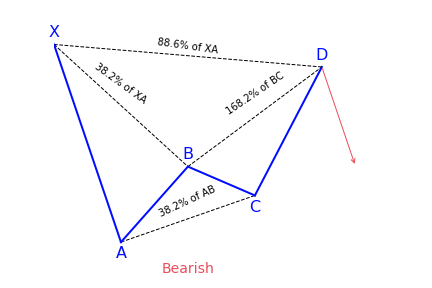

What is the Alternate Bat harmonic pattern?

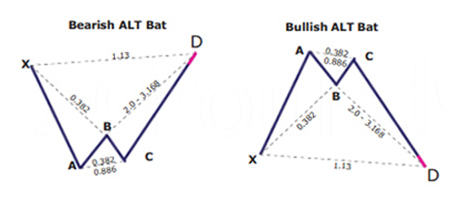

The alternate bat harmonic pattern is a variation of the Gartley pattern. Scott Carney developed it in 2003. It is popular for incorporating the 1.13XA retracement as the defining element in the Potential Reversal Zone (PRZ). The alternate bat harmonic pattern is one of the most precise trading patterns that works exceptionally great in the relative strength index (RSI) BAMM set up.

Key takeaways:

- The Alternate Bat pattern is popular for incorporating the 1.13XA retracement.

- Firstly, an important factor is the B point retracement that must be 0.382 retracements or it must be less of the XA leg.

- Furthermore, it only utilizes a 2 or more BC projections.

- The AB = CD pattern within the alternate bat pattern always extends requiring a 1.618 AB = CD calculations.

How to identify the Alternate Bat harmonic pattern?

The alternate bat is a unique trading pattern that involves certain precise measurements. Those measures are crucial in order to identify the alternate bat. A pattern must meet the following conditions to be an alternate bat pattern:

- The first important factor is the B point retracement that must be 0.382 retracements or it must be less of the XA leg.

- The alternate bat only utilizes 2.0 BC projections or greater than that.

- The AB = CD pattern within the alternate bat pattern always extends requiring a 1.618 AB = CD calculations.

- Generally, the best structures use 50% retracement at the midpoint.

Resources

https://www.forex.academy/the-alternate-bat-pattern/

https://patternswizard.com/alternate-bat-harmonic-pattern/

https://harmonictrader.com/harmonic-patterns/alternate-bat-pattern/

https://algorush.com/trading-academy/advanced-lessons/harmonic-patterns/common-harmonic-patterns/alternate-bat-pattern/

Start Harmonic Trading

Learn Harmonic Patterns

Trading Systems

-

From: $19.99 / month with 1 week free trial

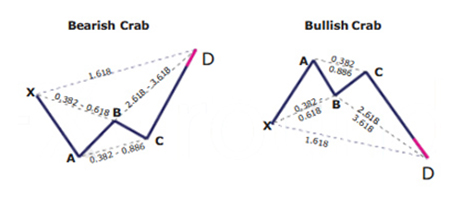

Crab Pattern

What is the Crab harmonic pattern?

The pattern was discovered in 2001. Just as it is with other harmonic patterns, this pattern is a reversal pattern. Therefore, we have the bearish crab pattern that indicates a bearish reversal in price and a bullish crab pattern that indicates a bullish reversal in price. Just as it is with other patterns, there’s a naming convention for every leg in the formation.

Key takeaways:

- The Crab harmonic pattern is a reversal pattern

- The Crab harmonic pattern is a 4 legged pattern

- The crab pattern follows strict Fibonacci ratios

Beginning with the swing low or high, every leg is marked by a letter. There are five swing points named as X, A, B, C and D. In some patterns, you will only find four (X, A, B and C).

The crab pattern is different because of its sharp movement in the CD leg. This is usually a 1.618 percent Fibonacci retracement of the XA leg, the previous part of the crab pattern.

Some rules that have to be followed to confirm a crab pattern, such as:

- Following the XA leg in price, the point B is a retracement of between 38.2 to 61.8 percent. This retracement should ideally be lower than 61.8 percent

- The AB leg, is a counter trend move to the initial leg

- After point B, the next leg, BC, can run up to 38.2 to 88.6 percent Fibonacci ratios of the AB leg (C should never go beyond point A)

- Following the BC leg, price reverses once again, with the CD leg being the longest and reversing between 161.8 percent of the XA leg and an extreme 224.0 to 361.8 percent extension of the BC leg

When a Crab harmonic pattern is confirmed

After the crab pattern confirms these factors, a position can be taken after the CD leg is made. Even though you will not notice the CD leg is always reversing close to 161.8 percent, if price action starts to stall and such a reversal begins to happen, it can be a high probability trade setup.

It is always better to wait until point D is made and then take an appropriate short or long position. Stop-losses are placed at the low or the high of D, and targets are typically points A or B in the pattern.

How to identify the Crab pattern?

It can be hard to be familiar with the Fibonacci retracement and extension values in a crab pattern. Also, it can become tiring when using the Fibonacci tool to measure each leg while drawing the crab pattern.

Aside from the main rules of the crab pattern, traders can look for the following signs in the market, by analyzing the lows and highs and simply observing the price movement.

- BC leg mostly exists within the XA leg

- C is a higher low as opposed to A in a bearish crab pattern or C is the lower high as opposed to A in a bullish crab pattern

- B makes a lower high when compared to X in a bearish crab pattern, or B makes a higher low when compared to X in a bullish crab pattern

- D is the extreme, indicating a lower low or a higher high, going beyond X

What does the Crab harmonic pattern tell traders?

Just like the butterfly, it can help traders identify when a current price move is likely getting to its end. This means traders can enter the market just as the price changes direction in the opposite way.

The crab and deep crab represent important overbought and oversold conditions, and reaction after completion is mostly sharp and fast. It is the opinion of many analysts and traders that the crab pattern and deep crab represent some of the quickest and most profitable patterns out of all harmonic patterns.

Trading a bearish Crab pattern

To trade a bearish crab pattern, put a short (sell) order at point D (the 161.8 percent Fibonacci extension of the XA leg).

- Entry: Identify where the pattern will end at point D, and place your order

- Stop-Loss: Put your stop-loss just below point D

- Take Profit: The location of your profit target is highly subjective and depends on your objectives and market conditions. If you desire aggressive profit, place it at point A of the pattern. For a more conservative profit, place it at point B.

Trading a bullish Crab pattern

First of all, choose the crab pattern charting tool and follow all the above rules to identify the pattern. Remember that the Fibonacci ratios are very important to trade the crab pattern. If you notice the pattern on a price chart and if you find the ratios not matching with the pattern rules, it means that the pattern is not valid. So do not trade that pattern.

When the price action confirms the pattern, immediately enter for a buy. If you are a conservative trader, ensure you wait for a couple of bullish confirmation candles before entering the trade.

There are four targets (X, B, C, A) to place the take-profit order in the crab pattern. At the start, traders try to book full profit at point A, but when the price crosses point B, the market turns sideways. So book half of your profit at point B and then close your full positions at point A.

Most of the traders placing their stop-loss way below point D; however, that’s a wrong way to do it because they are risking more due to this simple logic. If the price action breaks point D, it automatically invalidates the pattern.

Crab pattern vs. Butterfly pattern

The two main things that differentiate the crab pattern from the butterfly pattern is that a butterfly pattern has a swing point D that ends at the 127.2 percent Fibonacci extension of the XA leg. Also, the butterfly pattern retraces to 78.6 percent of the previous XA leg.

But when you consider the crab pattern, the swing point D ends at the 161.8 percent extension of the XA leg and terminates the AB leg between 38.2 percent and 61.8 percent. These two major differences in the Fibonacci ratios between the crab pattern and the butterfly pattern make them unique from each other.

References

https://patternswizard.com/crab-harmonic-pattern/

https://www.forex.academy/the-deep-crab-pattern/

https://www.babypips.com/learn/forex/the-gartley-and-the-animals/

https://forextraininggroup.com/trade-crab-pattern-deep-crab-pattern/

https://algorush.com/trading-academy/advanced-lessons/harmonic-patterns/common-harmonic-patterns/crab-pattern/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Looking for User Guides?

Instructions for Algo Rush Expert Advisors, Indicators & Dashboards.

Trading Systems

-

From: $19.99 / month with 1 week free trial

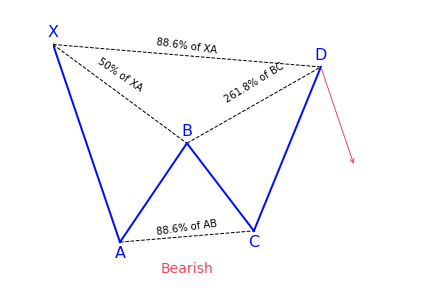

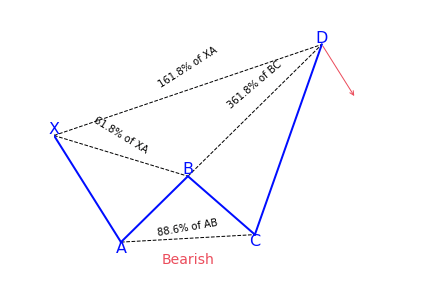

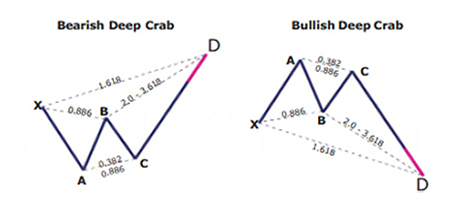

Deep Crab Pattern

What is the Deep Crab harmonic pattern?

The deep crab is a variation of the normal crab pattern. It is still a 5-point extension, and it still has the endpoint, D, at the 161.8 percent extension of XA, but the little difference is in the AB=CD importance.

Key takeaways:

- The Crab & Deep Crab harmonic patterns are reversal patterns

- The crab pattern follows strict fibonacci ratios

- The deep crab pattern also follows Fibonacci ratios (but with a slight variation)

The most distinguishing component of this pattern is the importance of the particular 88.6 percent retracement point of B. Together with the crab pattern; the deep crab pattern presents an especially extended and long move towards D.

How to identify the Deep Crab pattern?

It can be hard to be familiar with the Fibonacci retracement and extension values in a crab pattern. Also, it can become tiring when using the Fibonacci tool to measure each leg while drawing the crab pattern.

Aside from the main rules of the crab pattern, traders can look for the following signs in the market, by analyzing the lows and highs and simply observing the price movement.

- BC leg mostly exists within the XA leg

- C is a higher low as opposed to A in a bearish crab pattern or C is the lower high as opposed to A in a bullish crab pattern

- B makes a lower high when compared to X in a bearish crab pattern, or B makes a higher low when compared to X in a bullish crab pattern

- D is the extreme, indicating a lower low or a higher high, going beyond X

What does the Deep Crab harmonic pattern tell traders?

Just like the butterfly, it can help traders identify when a current price move is likely getting to its end. This means traders can enter the market just as the price changes direction in the opposite way.

The crab and deep crab represent important overbought and oversold conditions, and reaction after completion is mostly sharp and fast. It is the opinion of many analysts and traders that the crab pattern and deep crab represent some of the quickest and most profitable patterns out of all harmonic patterns.

References

https://patternswizard.com/crab-harmonic-pattern/

https://www.forex.academy/the-deep-crab-pattern/

https://www.babypips.com/learn/forex/the-gartley-and-the-animals/

https://forextraininggroup.com/trade-crab-pattern-deep-crab-pattern/

https://algorush.com/trading-academy/advanced-lessons/harmonic-patterns/common-harmonic-patterns/deep-crab-pattern/

Start Harmonic Trading

Learn Harmonic Patterns

Recent Trading Guides

-

December 18, 2020

Harmonic Patterns Explained For Beginners

-

November 17, 2020

Trading Breakouts within Price Action & Multiple Indicators

-

October 28, 2020

Importing High Quality Tick Data on MetaTrader 4 & 5

Trading Systems

-

From: $19.99 / month with 1 week free trial

Butterfly Pattern

What is the Butterfly harmonic pattern?

The butterfly pattern is a reversal chart pattern that is in the category of harmonic patterns. It shows price consolidation and is mostly noticed at the end of an extended price move.

Traders can apply the butterfly pattern to determine the end of a trending move and position for the start of a correction or new trend phase. You will often see this pattern during the last wave of the impulse sequence in Elliott wave terms.

Key takeaways:

- The Butterfly pattern is a harmonic reversal pattern

- It follows specific fibonacci ratios (which you can see in the structure part below)

The harmonic butterfly pattern, like all other harmonic patterns, is a reversal trading pattern that can be universally traded all the time. Some people prefer to trade them on higher time frames. Some many different structures and variations can be seen as butterfly structures. The butterfly looks similar to the Gartley 222 harmonic pattern, but the main advantage is that traders can buy and sell at new lows or highs because wave D terminates beyond the starting point of wave XA.

The pattern was discovered by Bryce Gilmore and Larry Pesavento, and it usually forms close to the extreme lows and highs of the market and predicts a reversal.

The butterfly pattern is made up of four legs marked X-A, A-B, B-C, and C-D. It helps traders determine when a current price move is probably getting to its end. This means traders can enter the market as the price changes direction.

How to identify the Butterfly pattern?

Just as mentioned earlier, the butterfly pattern resembles the bat and Gartley patterns, with four different legs labeled X-A, A-B, B-C, and C-D. The pattern tells traders when to sell after the pattern has completed.

X-A

In its bearish version, the first leg is formed when the price sharply falls from point X to A.

A-B

The A-B leg then notices the price switch direction and retraces 78.6 percent of the distance covered by the X-A axis.

B-C

In the B-C leg, the price changes direction for a second time and goes back down, retracing 38.2 to 88.6 percent of the distance covered by the A-B leg.

C-D

The C-D axis is the last and most significant part of this pattern. Just as it is with the Bat and Gartley patterns, you should also have an AB=CD structure to complete the butterfly pattern, but the C-D leg mostly extends to form a 127 or 161.8 percent extension of the A-B leg. Traders would be looking to enter at point D of the pattern.

A big variation with the butterfly pattern over the Bat or Gartley patterns is that traders look to place their trade entry order at the point where the C-D leg has reached a 127 percent Fibonacci extension of the X-A leg. It is the longest leg of the pattern. Generally, point D should also show a 161.8 to 261.8 percent extension of the B-C leg.

The pattern has four price swings, and its presence on the chart looks like the letter ‘M’ in downtrends, and ‘W’ in uptrends. During its formation, it can at times be mistaken for a double bottom or double top pattern.

What does the Butterfly pattern tell traders?

The Butterfly is one of the most important harmonic patterns due to its nature of where it shows up. Both Carney and Pesavento emphasized that this pattern shows the important highs and lows of a trend. In fact, by using various time frame analyses, it is common to see various butterfly patterns show up in different timeframes all at the end of a trend. The pattern is an example of an extension pattern and it generally forms when a Gartley pattern is invalidated by the CD wave going pass X.

There are two versions of this pattern that are bullish, in which traders are advised to buy, and bearish in which traders should sell. Precision is vital when it comes to applying the butterfly pattern because it allows traders to get rid of errors.

How to trade when you see the Butterfly harmonic pattern?

Before trading the butterfly harmonic pattern, confirm from the following checklist that the pattern is real. It should have the following vital elements:

- AB= an ideal target of 78.6 percent of XA leg

- BC= minimum 38.2 percent and maximum 88.6 percent Fibonacci retracement of AB leg