What is the Alternate AB=CD (ABCD) harmonic pattern?

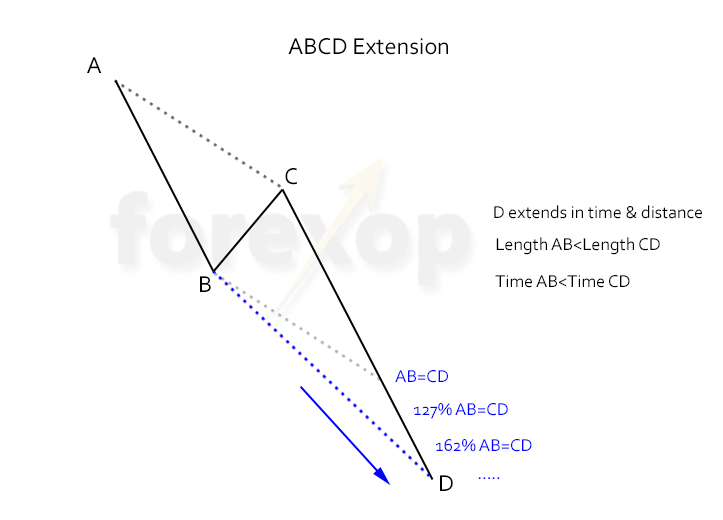

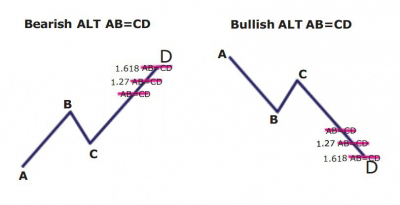

Many times ABCD patterns are not perfectly symmetrical or even close to. These are alternate ABCD patterns. The CD leg can be shorter or longer than the AB leg. But usually the CD leg is longer – these are called ABCD extensions. The Alternate AB=CD (also known as the Alternate ABCD) is an extension pattern which consists of 3 Fibonacci extension levels.

In an ABCD extension the retracement at D extends further than anticipated. The extension can be in time or price, but usually it’s both.

The common ABCD extension ratios are:

- CD = 127% x AB

- CD = 162% x AB

- CD = 262% x AB

When there’s an ABCD extension a bullish market makes higher highs than anticipated by the ideal pattern. In a bearish trend it’s the opposite, and the trend makes lower lows than otherwise predicted.

When checking an ABCD extension, anticipate higher volatility around point D.