Ultimate Breakout Indicator

The Ultimate Breakout Indicator is available on MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Traders can determine the trend with four different methodologies while scanning for precise and non-precise breakouts within price action and five various indicators. The ultimate breakout indicator can also be loaded on Order Snipe to allows users to view charts and trade stocks and futures charts on Interactive Brokers (IB) as well as crypto on several crypto exchanges including Binance, BitMEX, FTX, KuCoin and more.

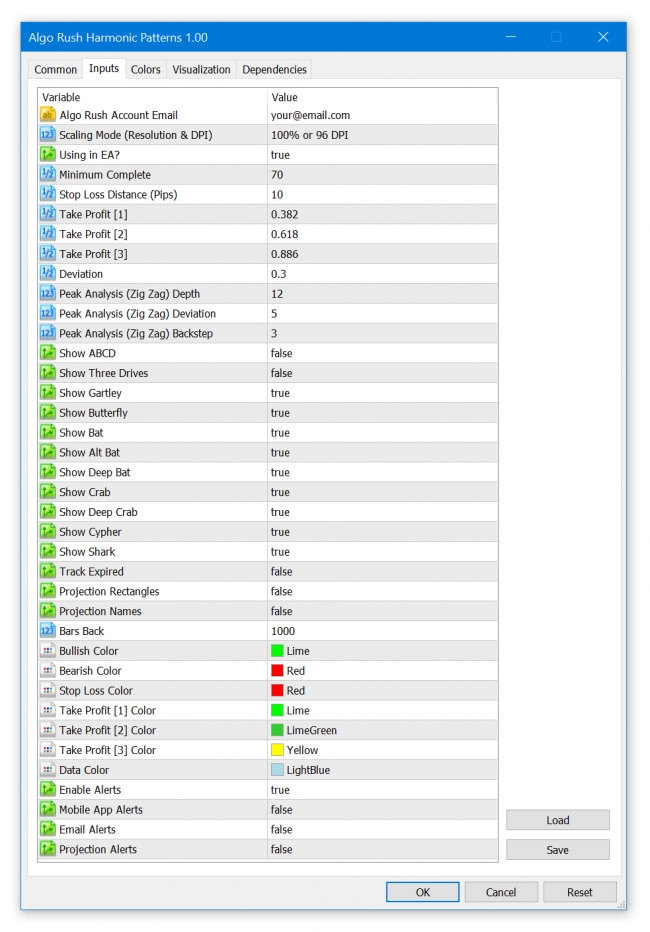

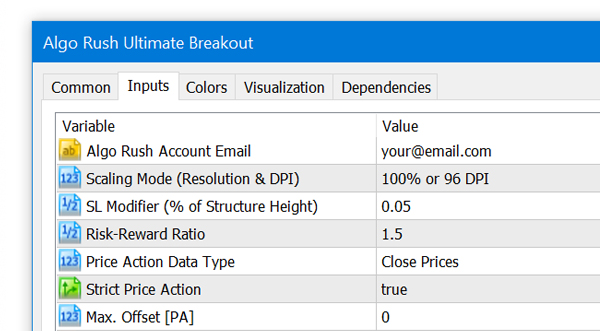

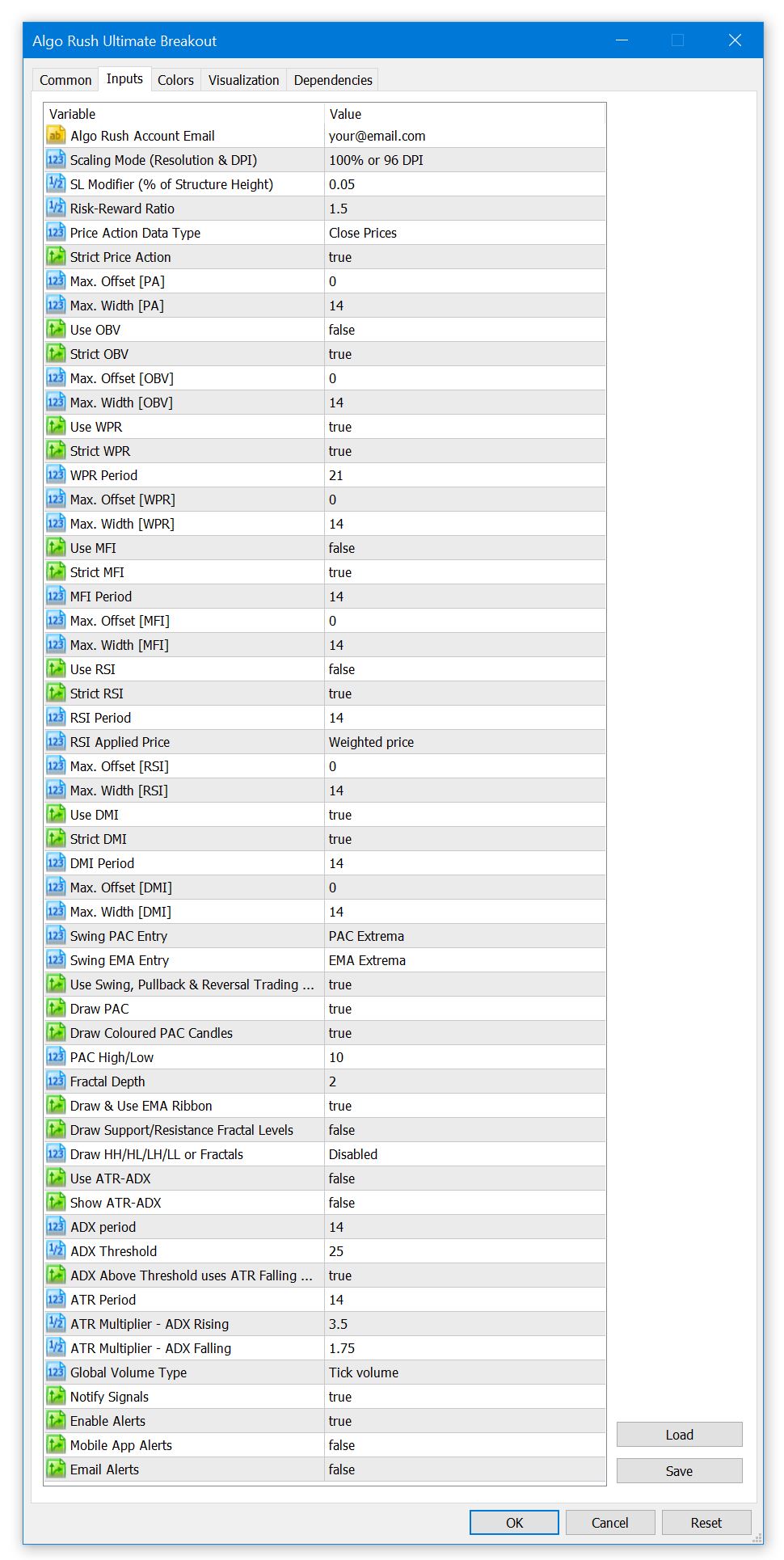

Ultimate Breakout Indicator Settings on MetaTrader 4 & 5

Algo Rush Account Email

The email address that the active Algo Rush subscription is under.

- Note: The indicators and Expert Advisors will not initiate without an email address linked to an active subscription.

Scaling Mode (Resolution & DPI)

Users with either resolutions above 1080p (1920×1080) or DPIs above 96 will need to adjust the scaling mode settings to an option above the default 100% value. Adjusting this will resolve any issues with displaying objects such as text, buttons and windows within active charts.

- 100% or 96 DPI (default)

- 125% or 120 DPI

- 150% or 144 DPI

- 175% or 168 DPI

- 200% or 192 DPI

- 225% or 216 DPI

- 250% or 240 DPI

SL Modifier (% of Structure Height)

The option to set an additional percentage offset away from the entry level and the calculated low of the double bottom or high of the double top structure.

- Default: 0.05 (5%)

Risk-Reward Ratio

The risk reward ratio is calculated by multiplying the distance between the anticipated entry level and the low of the double bottom (or high of the double top) to determine take profit levels. A risk-reward of 2-1 (default option) indicates that the distance of the take-profit from the desired entry level is twice the distance as the distance of the stop-loss from the desired entry level.

- Default: 2

Price Action Data Type

The price action data type is referring to the price form used to calculate structures within timeframe specific candle data.

- Close Prices (default)

- The close price will be used to calculate double bottoms and double tops for both directions.

- High & Low Prices

- For going long, the low price will be used to calculate double bottoms within price data.

- For going short, the high price will be used to calculate double tops within price data.

Strict Price Action

Defines if the double bottom or double top needs to have have a proper structure. By definition, proper structure for double bottoms include the right side being higher than the left side and for double tops the right side must be lower than the left side. If disabled, all double top and bottom structures will be accounted for within Price close or high/low data (depends on the option chosen above) regardless if proper or not. See image below:

- Default: True

Max. Offset [PA]

How many bars back a double bottom or double top structure is allowed to be formed within price data for the upcoming signal.

- Default: 0

Max. Width [PA]

Over how many bars a double bottom or double top structure is allowed to form a signal on price data.

- Default: 14 (a double bottom/top must form within the last 14 candlesticks)

Use OBV

Scan for double bottom and double top breakout structures within On Balance Volume (OBV) indicator data.

- Default: False

Strict OBV

Defines if the double bottom or double top needs to have have a proper structure. By definition, proper structure for double bottoms include the right side being higher than the left side and for double tops the right side must be lower than the left side. If disabled, all double top and bottom structures will be accounted for within On-Balance (Tick) Volume data regardless if proper or not. See image below:

- Default: True

Max. Offset [OBV]

How many bars back a double bottom or double top structure is allowed to be formed within On Balance Volume indicator data for the upcoming signal.

- Default: 0

Max. Width [OBV]

Over how many bars a double bottom or double top structure is allowed to form a signal on On-Balance (Tick) Volume data. Keep in mind that MOST pairs on MetaTrader offer tick volume rather than pure volume.

- Default: 14

Use WPR

Scan for double bottom and double top breakout structures within Williams %R (WPR) indicator data.

- Default: True

Strict WPR

Defines if the double bottom or double top needs to have have a proper structure. By definition, proper structure for double bottoms include the right side being higher than the left side and for double tops the right side must be lower than the left side. If disabled, all double top and bottom structures will be accounted for within Williams %R data regardless if proper or not. See image below:

- Default: True

WPR Period

The period MA used within the Williams %R indicator.

- Default: 21

Max. Offset [WPR]

How many bars back a double bottom or double top structure is allowed to be formed within Williams %R indicator data for the upcoming signal.

- Default: 0

Max. Width [WPR]

Over how many bars a double bottom or double top structure is allowed to form a signal on Williams %R data.

- Default: 14

Use MFI

Scan for double bottom and double top breakout structures within Money Flow Index (MFI) indicator data.

- Default: False

Strict MFI

Defines if the double bottom or double top needs to have have a proper structure. By definition, proper structure for double bottoms include the right side being higher than the left side and for double tops the right side must be lower than the left side. If disabled, all double top and bottom structures will be accounted for within Money Flow Index data regardless if proper or not. See image below:

- Default: True

MFI Period

The period MA used within the Money Flow Index (MFI) indicator.

- Default: 14

Max. Offset [MFI]

How many bars back a double bottom or double top structure is allowed to be formed within Money Flow Index indicator data for the upcoming signal.

- Default: 0

Max. Width [MFI]

Over how many bars a double bottom or double top structure is allowed to form a signal on Money Flow Index data.

- Default: 14

Use RSI

Scan for double bottom and double top breakout structures within Relative Strength Index (RSI) indicator data.

- Default: False

Strict RSI

Defines if the double bottom or double top needs to have have a proper structure. By definition, proper structure for double bottoms include the right side being higher than the left side and for double tops the right side must be lower than the left side. If disabled, all double top and bottom structures will be accounted for within Relative Strength Index applied price data (chosen below) regardless if proper or not. See image below:

- Default: False

RSI Period

The period MA used within the Relative Strength Index (RSI) indicator.

- Default: 14

RSI Applied Price

The price form to use when calculating price within Relative Strength Index (RSI) indicator data.

- Default: Weighted Price

- Close Price

- Open Price

- High Price

- Low Price

- Median Price

- Typical Price

Max. Offset [RSI]

How many bars back a double bottom or double top structure is allowed to be formed within Relative Strength Index (RSI) indicator data for the upcoming signal.

- Default: 0

Max. Width [RSI]

Over how many bars a double bottom or double top structure is allowed to form a signal on Relative Strength Index data.

- Default: 14

Use DMI

Scan for double bottom and double top breakout structures within Directional Movement Index (DMI) indicator data.

- Default: True

Strict DMI

Defines if the double bottom or double top needs to have have a proper structure. By definition, proper structure for double bottoms include the right side being higher than the left side and for double tops the right side must be lower than the left side. If disabled, all double top and bottom structures will be accounted for within Directional Movement Index data regardless if proper or not. See image below:

- Default: True

DMI Period

The period MA used within the Directional Movement Index (DMI) indicator.

- Default: 14

Max. Offset [DMI]

How many bars back a double bottom or double top structure is allowed to be formed within Directional Movement Index data for the upcoming signal.

- Default: 0

Max. Width [DMI]

Over how many bars a double bottom or double top structure is allowed to form a signal on Directional Movement Index data.

- Default: 14

Swing PAC Entry

Prerequisite entry condition requiring that the price respects the following Price Action Channel limits:

- Default: PAC Extrema

- PAC Mid (Close)

- PAC Opposite

- Disabled

Swing EMA Entry

Prerequisite entry condition requiring that the price respects the following EMA ribbon limits:

- Default: EMA Extrema

- EMA Mid (Close)

- EMA Opposite

- Disabled

Use Swing, Pullback & Reversal Trading System

Enables the usage of PAC and EMA Ribbons as prerequisites for entry conditions.

- Default: True

Draw PAC

- Default: True

Draw Coloured PAC Candles

- Default color: DarkGreen

PAC High/Low

The period (amount of bars) for the Price Action Channel calculation.

- Default: 10

Fractal Depth

How many candles left and right should be used to calculate. Example: if 2 is selected, from the middle candle it will scan 2 candles left and 2 candles right for a total of 5 candles. The default 2 is a classic 5-bar fractal, see image below.

- 1

- Default: 2

- 3

- 4

- 5

Draw & Use EMA Ribbons

- Default: True

Draw Support/Resistance Fractal Levels

Draws lines that represent support and resistance based off the value inputted for the “Fractal Depth” option.

- Default: True

Enable Alerts

- Default: true

Mobile Alerts

- Default: false

Mail Alerts

- Default: false

References

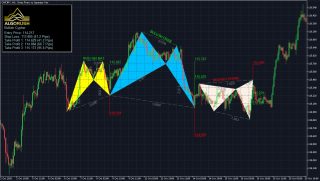

https://algorush.com/wiki/harmonic-patterns-indicator

https://algorush.com/trading-systems-for-metatrader/harmonic-patterns-indicator/