sdasdsa

As you may have guessed, profiting off Harmonic Price Patterns is all about being able to spot those “perfect” patterns and buying or selling on their completion.

There are three basic steps in spotting Harmonic Price Patterns:

- Step 1: Locate a potential Harmonic Price Pattern

- Step 2: Measure the potential Harmonic Price Pattern

- Step 3: Buy or sell on the completion of the Harmonic Price Pattern

By following these three basic steps, you can find high probability setups that will help you grab those oh-so-lovely pips.

Let’s see this process in action!

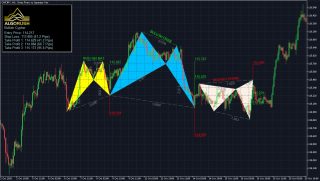

Step 1: Locate a potential Harmonic Price Pattern

Oh wow, that looks like a potential Harmonic Price Pattern! At this point in time, we’re not exactly sure what kind of pattern that is.

It LOOKS like a three-drive, but it could be a Bat or a Crab…

Heck, it could even be a Moose!

In any case, let’s label those reversal points.

Step 2: Measure the potential Harmonic Price Pattern

Using the Fibonacci tool, a pen, and a piece of paper, let’s list down our observations.

- Move BC is .618 retracement of move AB.

- Move CD is 1.272 extension of move BC.

- The length of AB is roughly equal to the length of CD.

This pattern qualifies for a bullish ABCD pattern, which is a strong buy signal.

Step 3: Buy or sell on the completion of the Harmonic Price Pattern

Once the pattern is complete, all you have to do is respond appropriately with a buy or sell order.

In this case, you should buy at point D, which is the 1.272 Fibonacci extension of move CB, and put your stop loss a couple of pips below your entry price.

Is it really that easy?

Not exactly.

The problem with harmonic price patterns is that they are so perfect that they are so difficult to spot, kind of like a diamond in the rough.

More than knowing the steps, you need to have hawk-like eyes to spot potential harmonic price patterns and a lot of patience to avoid jumping the gun and entering before the pattern is completed.

asdas

How to Trade Harmonic Patterns

Pattern Identification

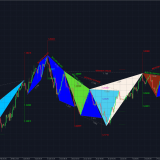

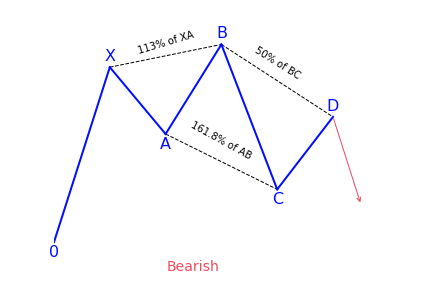

Harmonic patterns can be a bit hard to spot with the naked eye, but, once a trader understands the pattern structure, they can be relatively easily spotted by Fibonacci tools. The primary harmonic patterns are 5-point (Gartley, Butterfly, Crab, Bat, Shark and Cypher) patterns. These patterns have embedded 3-point (ABC) or 4-point (ABCD) patterns. All the price swings between these points are interrelated and have harmonic ratios based on Fibonacci. Patterns are either forming or have completed “M”- or “W”-shaped structures or combinations of “M” and “W,” in the case of 3-drives. Harmonic patterns (5-point) have a critical origin (X) followed by an impulse wave (XA) followed by a corrective wave to form the “EYE” at (B) completing AB leg. Then followed by a trend wave (BC) and finally completed by a corrective leg (CD). The critical harmonic ratios between these legs determine whether a pattern is a retracement-based or extension-based pattern, as well as its name (Gartley, Butterfly, Crab, Bat, Shark, and Cypher). One of the significant points to remember is that all 5-point and 4-point harmonic patterns have embedded ABC (3-Point) patterns.

All 5-point harmonic patterns (Gartley, Butterfly, Crab, Bat, Shark, Cypher) have similar principles and structures. Though they differ in terms of their leg-length ratios and locations of key nodes (X, A, B, C, D), once you understand one pattern, it will be relatively easy to understand the others. It may help for traders to use an automated pattern recognition software to identify these patterns, rather than using the naked eye to find or force the patterns.

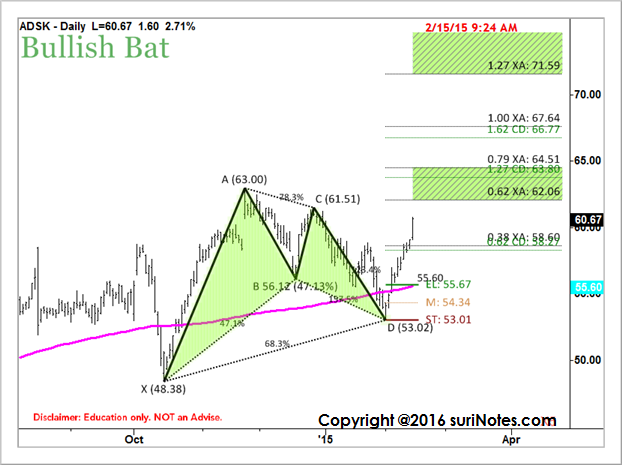

Example: The following chart shows an example of the Bullish Bat pattern with embedded the ABC Bearish pattern. The identification pivots and ratios are marked on the pattern; the pattern also shows the entry, stop and target levels.

Trade Identification

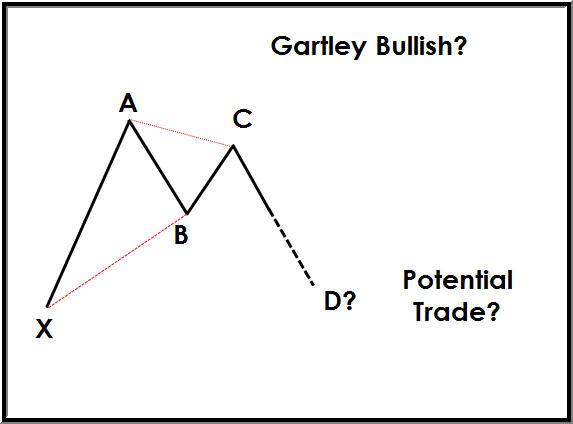

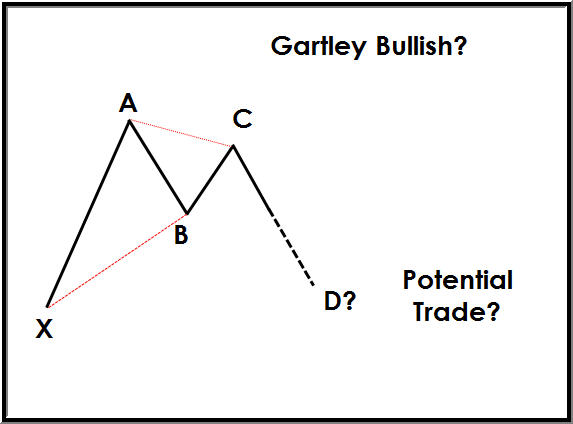

In harmonic pattern setups, a trade is identified when the first 3 legs are completed (in 5-point patterns). For example, in Gartley Bullish pattern, the XA, AB and BC legs are completed and it starts to form the CD leg, you would identify a potential trade may be in the works. Using the projections and retracements of the XA and BC legs, along with the Fibonacci ratios, we can build a price cluster to identify a potential Pattern Completion Zone (PCZ) and D point of the pattern.

Trade Entries and Stops

Trading harmonic patterns with computed entry levels are this author’s preference rather than trading them blindly at retracement levels or reversal zones advocated by harmonic trading pundits. Most harmonic traders anticipate the pattern to reverse and attempt to trade these patterns in the “reversal zone” and end up taking contrarian (counter trend) trades. To enter a trade, I prefer a confirmation of reversal price-action combined with a reversal trend change from the “reversal zones.”

Most harmonic pattern trade entries occur around “D” point within the reversal zone. It could be a Buy (in bullish patterns) or a Sell (in bearish patterns). Usually, “D” is identified by a confluence of projections, retracements, and extensions of prior swings (legs), universally called as “reversal zone.” In my view, when prices started to reach this zone, it is signaling an opportunity for potential trade, not a signal to trade yet. The entry criteria and pattern validity are determined by various other factors like current volatility, underlying trend, volume structure within the pattern and market internals etc. If the pattern is valid and the underlying trend and market internals agreeing with the harmonic pattern reversal, then Entry levels (EL) can be calculated using price-ranges, volatility or some combination. Stop is placed above/below the last significant pivot (in 5 and 4-Point patterns it is below D for the bullish pattern, above D for bearish patterns).

Target Zones

Target zones in harmonic patterns are computed based on the retracement, extensions or projections of impulse/corrective swings and Fibonacci ratios from the action point of the pattern structure. For example, in Gartley bullish pattern, the target zones are computed using the XA leg from the trade action point (D). The projections are computed using Fibonacci ratios like 62% or 78.6% of the XA leg and added to the action point (D). The extension ratios like 1., 1.27, 1.62, 2., 2.27 or 2.62 are computed for potential target levels. The primary target zones are computed from D, with 62%-78.6% of the XA leg as the first target zone and 127%-162% as the second target zone.

Target Zone1: (D + XA*0.62) to (D+XA*.786)

Target Zone2: (D + XA*1.27) to (D+XA*1.62)

It is important to note that potential target zones in harmonic patterns are computed from a probability standpoint, not with absolute certainty. Strong money and risk management rules and full working knowledge of the pattern are necessary for any pattern trading success.

Example: The following chart shows a Bullish Gartley Pattern with an entry level, stops and target zones. The target zones are projected using XA swing length and Fibonacci ratios from D. Target Zone 1 comprises the range of 62%-79%, while Target Zone 2 runs from 127% to 162%.

Key takeaways:

- The 5-0 pattern is a reversal harmonic pattern.

- It follows specific fibonacci ratios (which you can read more below)

The patterns are relatively new but are getting more popular lately. It stands out from the other harmonic patterns because it is meant to begin a new trend rather than discover retracement. There are two types of this pattern, bullish and bearish.

The convergence zones discovered with the help of the shark pattern makes it possible for us to accurately detect the rebound but doesn’t necessarily lead to the restoration of the previous trend. On the other hand, regular rollbacks aim to determine the ability of the forces dominant on the market in the previous period (bears or bulls) to get the initiative back to their disposal. If they are not sufficient, the last reversal of the previous trend occurs, but already within another pattern – 5-0 harmonic pattern.

How to identify the 5-0 pattern?

The 5-0 pattern begins with either an uptrend or a downtrend which gets exhausted and draws zigzag like corrective movements. The qualities of the 5-0 pattern to look at include:

- AB movement has to be 1.13 to 1.618 retracement of XA.

- BC movement has to be 1.618 to 2.24 retracement of an AB.

- CD movement ought to be 0.5 retracements of BC

- C should be between 0.886 and 1.13 of 0X movement

If the conditions are satisfied, some traders trade the last leg of CD. They entering at C with a stop below 2.24 of AB retracement and aiming at 50 percent correction of BC movement.

The 5-0 harmonic pattern is traded when the price is getting to point D. The stop-loss is positioned a few ticks below/above the farthest possible D level. Unlike a lot of the other patterns, 5-0 doesn’t have specific targets because it usually begins a new trend. Here the pattern fib ratios don’t matter much. Entries might be done with a limit order or on price reversals away from point D. All entries have to be confirmed for risk/reward ratio. Entries having less risk/reward have to be taken cautiously or discarded altogether.

A reliable indicator should automatically scan for, recognize, display, and alert emerging 5-0 and other harmonic chart patterns. It indicates the name of the pattern, when it happened, and the stop price. The pattern scanner goes through various charts in the same period and assists traders to find trading opportunities as soon as they come up.

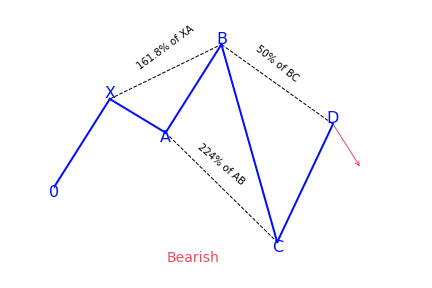

Bearish 5-0 pattern

To correctly identify the bearish 5-0 pattern, first, find the shark pattern, wait for the implementation of its targets at 88.6 or 113 percent, and the following rollback in the direction of 50 percent of the BC wave. The length of this wave in both graphic configurations is 161.8 to 224 percent of AB. If after the convergence zones of the shark pattern is reached, a correction in the direction of 23.6 percent, 38.2 percent, or 50 percent has followed, we can talk about the transformation of the real pattern into 5-0.

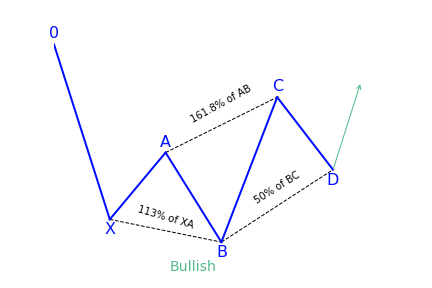

Bullish 5-0 pattern

After the target at 113 percent of the shark harmonic pattern was achieved, it was followed by a rollback in the direction of 38.2 percent of the CD wave. The trader has to search for this place for confirmation signals to create a long position. It can be both indicators, prompts from price action, or other items and techniques used for technical analysis.

What does the 5-0 pattern tell traders?

The 5-0 harmonic chart pattern suggests a long entry upon completion of the pattern or confirmation of the D point of the pattern. The pattern is a unique 5-point reversal structure that typically shows the first pullback of an important trend reversal. It is a relatively new pattern that has 4 legs and particular Fibonacci measurements of each point within the structure, creating room for better flexible interpretation. The Potential Reversal Zone (PRZ) is described differently from other harmonic chart patterns.

Conservative traders look for more confirmation before getting into a trade. Targets for this pattern can be placed at the discretion of the trader as the reversal point could be the beginning of a new trend. Common stop-loss levels are found behind a structure level beyond the D point or the next vital level for the Fibonacci sequence.

How to trade when you see the 5-0 pattern?

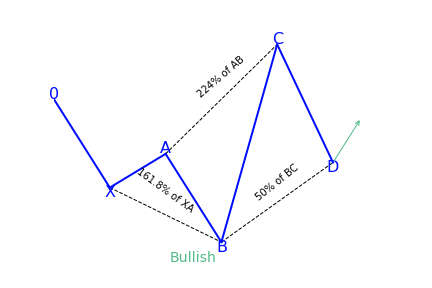

One of the best processes of interpreting this pattern is to look at it from a tired and frustrated trader’s point of view. Taking the bullish 5-0 pattern as an example, then we can see why. The AB leg ends with B below X, making a lower low. We then get a longer move in time where the BC leg is the most prolonged move with C ending over A.

The movement from B to C may look like a bear flag or bearish pennant. C to D indicates intense shorting pressure and a belief among bears that new lows are on the way. Rather, we get to D – the 50 percent retracement of BC. Rather than new lower lows, we get a confirmation swing forming a higher low. That move will most probably create a brand new trend reversal or significant corrective move.

The elements of trading the 5-0 pattern

- The pattern starts (with 0) at the beginning of a long price move

- After 0 has formed, an impulse reversal at X, A, and B should have a 113 to 161.8 percent extension

- The projection off of AB has a 161.8 percent extension requirement to C. C can extend beyond the 161.8 percent extension but not beyond 224 percent.

- D is the 50 percent retracement of BC and is same as AB

- The reciprocal AB=CD is needed

Drawing the 5-0 pattern properly

To perfectly draw or locate a 5-0 harmonic chart pattern on the price chart, first of all, we need to locate the X and A points of the pattern. The X point is seen at the bottom of a strong bearish trend. The A point is found at the top of a bullish trend. The next thing traders need to do is to draw a Fibonacci retracement tool from X to A to determine the B point of the chart pattern. The B point should be within the 113 percent to 161.8 percent Fibonacci retracement of XA.

In the last step, we will get the entry point, D point, of the 5-0 harmonic chart pattern. To get the D point of the pattern, draw a Fibonacci retracement tool from B to C. The D point has to be at the 50 percent Fibonacci retracement of BC.

Traders can be sure when the D point of the pattern is confirmed. The stop-loss for the order should be set at the lower support level. The profit target for the order should be placed within the 50 to 88.6 percent Fibonacci retracement of CD.

The C axis can also be traded, if it is the D point of a bearish harmonic chart pattern. The B point can be traded if the entries are confirmed by the other tools for technical analysis.

References

https://patternswizard.com/5-0-harmonic-pattern/

https://harmonictrader.com/harmonic-patterns/5-0/

https://www.liteforex.com/blog/for-beginners/5-0-pattern-shark-hunt/

https://www.orbex.com/blog/en/2017/03/catch-key-reversals-5-0-pattern

https://algorush.com/trading-academy/advanced-lessons/harmonic-patterns/harmonic-trading-101/how-to-trade-harmonic-patterns/